Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

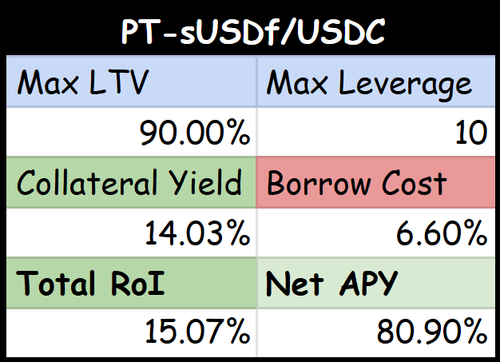

A fresh $2m USDC has been added to the PT-sUSDf market, bringing borrow costs to 6.6% APR

Meanwhile, PT-sUSDf fixed rates have shot up to 14% APY (+9% WoW)

Assuming borrow rates stay stable, PT-sUSDf/USDC loops are looking at a HEFTY 80.9% APY (15% RoI over 68 days)

Great thing about PTs is even if implied yields go down, entering no lets you lock in that sweet 14% APY.

The market uses a fundamental oracle + USDf:USDC so liquidation risk is VERY low.

Check it out here:

😘😘😘

2,16K

Johtavat

Rankkaus

Suosikit