Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

1/ DeFi on @Solana isn’t slowing down.

From LST adoption to perps, borrow/lend to stablecoins—every vertical is showing strength.

Let’s break down what happened in June 🧵👇

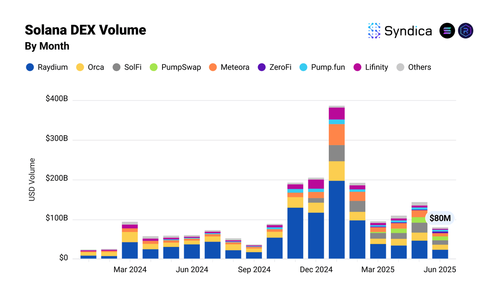

2/ @Solana DEXes surpassed a cumulative $1T in volume in the first half of 2025.

H1 2025 DEX volume on Solana exceeded the total volume from the previous two half-years combined.

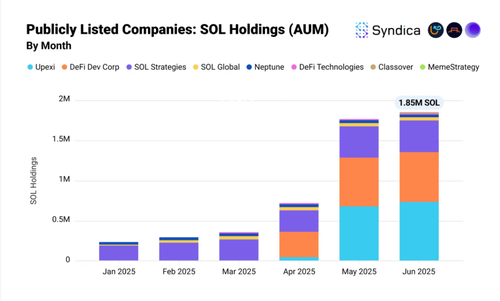

@solana 3/ Public companies continued their strategic accumulation of SOL.

They now cumulatively hold 1.85M $SOL or 0.35% of $SOL supply.

Classover and @MemeStrategy_ joined the trend, initiating their $SOL treasury holdings.

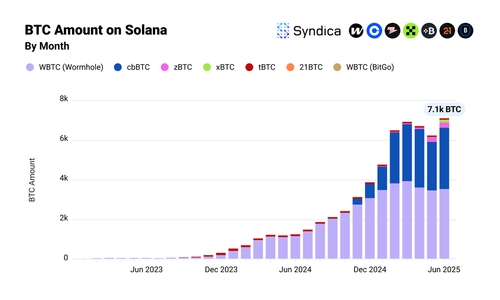

@solana @MemeStrategy_ 4/ @Solana is rapidly becoming Bitcoin's home.

The amount of $BTC on Solana reached an ATH of 7.1k $BTC in June, consistently rising since 2023.

New high-quality wrapped $BTC continued to flow in, with @OKX launching $xBTC last month, quickly attracting 135 $BTC.

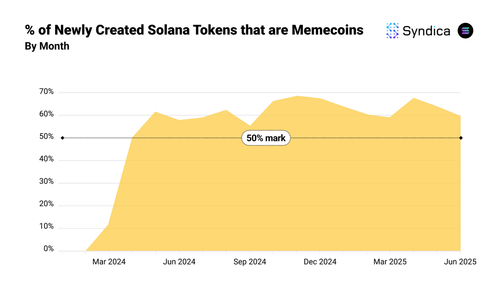

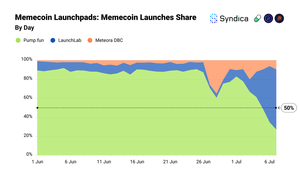

@solana @MemeStrategy_ @okx 5/ Memecoin launches on @Solana show no signs of slowing down.

Since April 2024, they made up more than half of new tokens monthly.

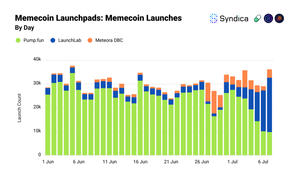

@solana @MemeStrategy_ @okx 6/ The memecoin launchpad landscape is quickly evolving.

@Pumpdotfun’s dominance is challenged; its share of daily token launches fell below 50% for the first time, as new competitors swiftly enter the market.

@solana @MemeStrategy_ @okx @pumpdotfun 7/ June saw the lowest DEX volumes on @Solana YTD.

Monthly trading volume settled at $80B, led by @RaydiumProtocol with a commanding $23B.

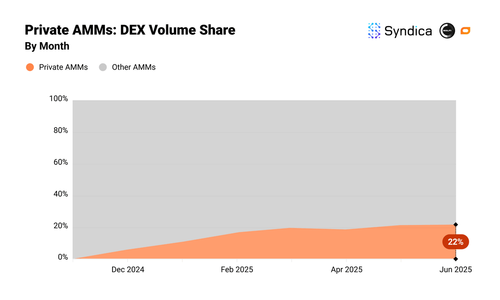

@solana @MemeStrategy_ @okx @pumpdotfun @RaydiumProtocol 8/ Private AMMs are reshaping @Solana's DEX ecosystem, handling 20%+ of all volume.

Traders favor aggregators, and private AMMs win that flow with cheaper trades, especially on short-tail assets.

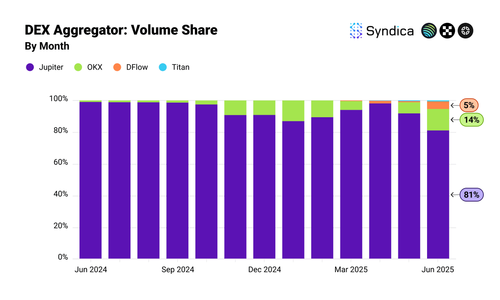

@solana @MemeStrategy_ @okx @pumpdotfun @RaydiumProtocol 9/ @Solana’s DEX aggregator competition is fiercer than ever.

While @JupiterExchange leads with 81% market share, @OKX and @DFlowProtocol are rapidly closing the gap, achieving new monthly highs of 14% and 5% in June.

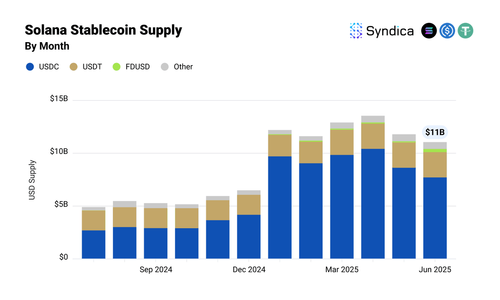

@solana @MemeStrategy_ @okx @pumpdotfun @RaydiumProtocol @JupiterExchange @DFlowProtocol 10/ @Solana's stablecoin momentum cooled following the Q1 2025 run-up.

Stablecoin supply pulled back 18.5% from earlier highs, settling at $11B.

$USDC gave back a chunk of the inflows that accompanied the $TRUMP memecoin trade as its price momentum faded.

@solana @MemeStrategy_ @okx @pumpdotfun @RaydiumProtocol @JupiterExchange @DFlowProtocol 11/ $FDUSD is now the third-largest stablecoin on @Solana.

The 1:1 USD-backed token from Hong Kong’s @FDLabsHQ 3x-ed its supply in June, reaching $300M.

Its success on Solana suggests users are open to stablecoin options beyond $USDC and $USDT.

@solana @MemeStrategy_ @okx @pumpdotfun @RaydiumProtocol @JupiterExchange @DFlowProtocol @FDLabsHQ 12/ @KaminoFinance TVL stabilized at 13.5M SOL after TVL jumped 50% in Q1, driven by the $TRUMP launch.

Its recent V2 launch expanded Kamino's lending market offerings.

4,92K

Johtavat

Rankkaus

Suosikit