Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

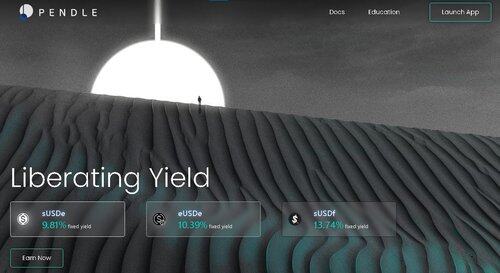

A yield platform isn't "just" what Pendle is.

It's slowly but surely becoming DeFi's yield layer.

Here are the main reasons why PENDLE will rule all major chains in 2025: (DeFi, yield, stablecoins, TVL, APY within)

1. Yield can be tokenized with Peddle.

Avoid stake-and-wait strategies. Far from pray-for-airdrop.

The term "yield" is split into two parts: YT represents speculation on APY, while PT represents principal that can be borrowed, traded, or looped.

What is the outcome?

An actual yield market that you may trade in.

Two, what makes this so meta?

Pendle turned APY into a marketable asset in and of itself.

In other words:

Potential long/short yields for DeFi traders

Expanding into new markets is possible with LSTs and stables.

Fluid, Ethena, and Kamino are just a few protocols that utilize it for liquidity techniques.

Thirdly, 15% APYs were considered ridiculous in 2024.

By the year 2025, farmers are using Pendle:

18–25% for each $sUSD

save more than 30% on $jUSDT

get a discount of 40% or more on certain LRT sets

Turned into tokens.

Everything is swappable.

Guaranteed by actual TVL.

Fourthly, Pendle's TVL has recently surpassed $6 billion in sales worldwide.

Ethereum

Final decision

Base

Solana through Kamino

as well as zones linked to Layer Zero

Multi-chain, multi-stablecoin, multi-metastable.

Yield farming is simply one aspect of this.

Yield architecture is what it is.

How is Pendle made to be sticky?

* sYUSD (stable yield index) * vePENDLE governance meta * Integrations with Kamino, Ethena, Fluid, and more * * PenPie/Boros for boosted strategies

Other protocols rely on the liquidity layer, which is called Pendle.

You're not ahead of the curve if you disregard Pendle; you're completely off track.

Tokenization is taking over every industry, including yield, interest rates and incentives for government.

Pendle has chosen not to ride this wave.

Making the surfboard is what it is.

In a nutshell, the greatest yield in DeFi isn't secret. The data is represented by tokens.

1,47K

Johtavat

Rankkaus

Suosikit