Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

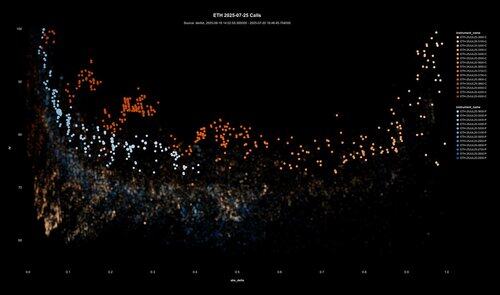

Lively Sunday session in ETH-25JUL25 options.

Flow seems to bet on continuation.

Vols got lifted and call skew emerged.

I used an opacity filter to highlight today's trades.

The vol gap in 10-30 δ hints at the use of risk reversals, i.e. funding upside calls by selling downside puts.

Meanwhile, far OTM puts were traded relatively more than calls. This could be part of downside capping risk reversals, i.e. buying back the tail so the short put becomes a short put spread.

6,36K

Johtavat

Rankkaus

Suosikit