Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

🧠 @SentoraHQ x @Asphere_xyz x $ADM — The Intelligent Network of the New Financial Order

If $Bloomberg Terminal was the heart of $TradFi,

then Sentora is about to become the brain of $DeFi.

But this isn’t just analytics.

This is a sovereign, vertically integrated AI-infrastructure for risk, security, intelligence, and decision-making in $Web3.

At its core lies the $ADM token, capturing the entire stack of monetization, access, and staking.

—

⚙️ A Truly Unmatched Architecture:

🔗 @Asphere_xyz — RPC node infrastructure powering 75+ blockchains

Real-time on-chain data streaming with ultra-low latency.

🧠 @SentoraHQ — AI for risk, simulation & threat analytics

Transforms data into actionable dashboards, signals, and APIs.

Already used by: $Curve, $Bitget, $CoinMarketCap, $Aave v3, $Ethena, $Bitstamp, and others.

💠 @OfVoice25355 ( ADM Token — Smart Money Coordination Layer)

Gates access to premium features, licenses, signals, APIs, and staking.

Think $LINK + $GRT + $CRV, but fully vertically monetized.

—

🧬 Why this is 10x more powerful than $Dune, $Nansen, or $Arkham:

•Dune gives SQL. Sentora delivers AI.

•Nansen watches wallets. Sentora evaluates risk.

•Arkham maps graphs. Sentora builds probabilities.

This isn’t analytics.

This is predictive intelligence for funds, protocols, and DAOs.

—

🧨 $ADM Price & Cap Potential:

•Prime contender as the default infrastructure token for risk & compliance in DeFi

•With scaling:

🔹 Market Cap: $1B–$3B

🔹 Global staking model + institutional demand

—

🧠 The Team:

@admff492 — ex-UBS, Head of Risk at HSBC.

Deep strategist fluent in compliance, derivatives, regulation, and institutional-grade AI.

— @jrdothoughts

🧩 TL;DR:

•$Asphere = Nodes

•$Sentora = Risk Operating System

•$ADM = Value Capture Engine

This is the brain, skeleton, and blood of a new financial Web3 order.

Don’t invest in a chart.

Invest in the Intelligent Network.

ADM. Sentora. Asphere. This is it.

🔥 A New Digital Giant Is Emerging 🔥

When Ripple builds the bridge between TradFi and onchain infrastructure — @Firelightfi is born.

When Flare turns decentralization into real revenue through SSNs and @XRP_Alerts staking — $stXRP emerges.

When Sentora, in partnership with Asphere, launches an institutional-grade risk analytics engine — a next-gen infrastructure is created where data controls capital.

And this isn’t just a collection of projects.

This is one unified ecosystem, driven by a team where:

•🧠 @admff492 — a visionary leader who went from CEO of top-tier financial institutions to architect of secure crypto-economic systems.

•⚙️ $Sentora — the platform transforming real-time onchain data into APIs, dashboards, and widgets for CEXs, DEXs, and DeFi.

•⚡ $ADM Token — the bridge between Data, Risk, and Agent-based infrastructure. Its utility will power everything — from Uniswap risk analytics to auto-liquidity management strategies.

📊 Together, they form a seamless chain:

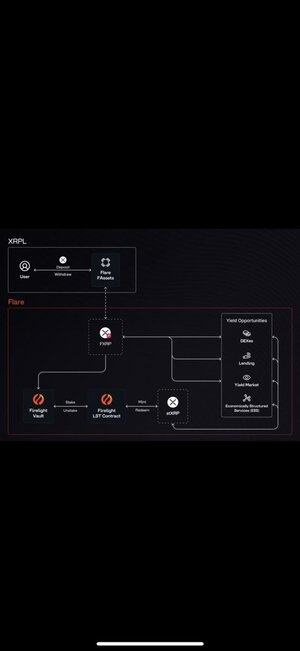

•$XRPL → $FXRP → $Firelight → $stXRP → $DeFi yield

•@SentoraHQ + @Asphere_xyz → Institutional APIs → CoinMarketCap, Bitstamp, AAVE, Curve & more

•ADM → Native fuel of the AI + DeFi infrastructure layer

This is not just evolution —

This is the rise of the next financial operating system.

3,31K

Johtavat

Rankkaus

Suosikit