Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

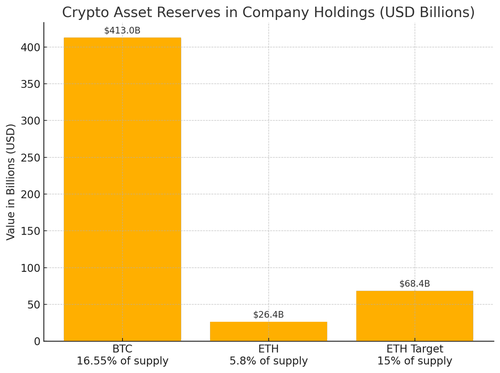

🧵1/ There’s a direct link between the value of crypto assets and how much of it companies are locking up in reserves or ETFs.

As corporate & institutional holdings grow, so does price.

It happened with Bitcoin.

It’s happening now with Ethereum.

Let’s compare 👇

2/ 🟠 Bitcoin

📊 199 entities hold 3.475M BTC

💰 Worth $413B

📈 That’s 16.55% of all BTC supply

Bitcoin became a macro treasury asset. Companies raced to add it to their balance sheets, and price followed.

3/ 🔵 Ethereum (today)

📊 Just 57 entities hold 7M ETH

💰 Worth only $26.45B

📉 That’s just 5.8% of ETH supply

ETH is still early in its treasury adoption curve. But the pattern is echoing Bitcoin’s earlier response.

4/ 🚀 Several major firms have announced plans to buy billions worth of ETH in the coming months.

If ETH treasury holdings reach 15% of supply by year-end, we’d see:

📊 18M ETH

💰 ~$68.4B held

🆙 That’s a potential + $42B in added demand.

5/ The upside for ETH will be massive.

The blueprint is already there.

It’s called Bitcoin.

📈 As Ethereum increses its strategic reserve asset footprint, its valuation will respond in kind.

The ETH treasury era has only just begun.

References:

3,87K

Johtavat

Rankkaus

Suosikit