Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

$BTC just broke back-to-back ATHs - yet it remains an underutilized asset.

BTCFi projects aim to change that, but no clear leader has emerged.

Can @yalaorg, with its unique approach, spark the next era of BTCFI? 🧵

Tldr;

@yalaorg is aiming to become a Bitcoin-native liquidity protocol by addressing three key pain points:

🛑 BTC is underutilized (60% Crypto Market cap vs 1% of Bitcoin's total supply being utilized)

🛑 BTCFi is fragmented - Overly siloed and isolated

🛑 Stablecoins ≠ backed by BTC

The holders' pain points persist:

Due to its limitations, most BTC investors have only been able to hold firmly and wait for appreciation. Some manage to sell and participate in yield-generating projects to increase turnover, but bear the custodial risks.

In other words, the current model forces BTC holders to turn $BTC into a “staking miner”, giving up $BTC to support the security services of other ecosystems (providing yields for BTC).

Yala's approach flips the old model. Instead of providing yields for $BTC, yala allows users to actually earn yields from $BTC.

At its core, Yala uses its $YU, a BTC-backed stablecoin, to unlock Bitcoin's potential, enabling its liquidity in DeFi and RWA across ecosystems.

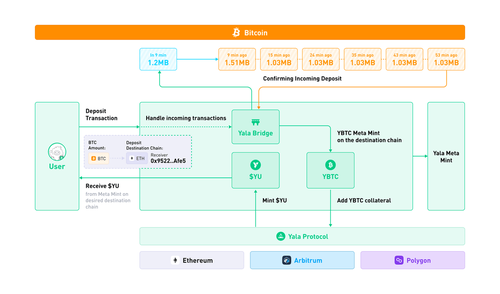

To facilitate cross-chain bridging, Yala utilized MetaMint, its bespoke cross-chain protocol, to securely bridge Bitcoin to other ecosystems.

Here’s how it works:

1️⃣ Deposit BTC into MetaMint (trustless, no wrapping)

2️⃣ Mint $YU, the BTC-backed stablecoin (On any desired chain)

3️⃣ Use $YU to earn yield on Solana, Ethereum, and beyond

Yala, as a liquidity layer, turns Bitcoin into an active asset for DeFi and RWA, using the $YU stablecoin as a bridge across ecosystems.

It’s like MakerDAO + Pendle + Lido… but for Bitcoin.

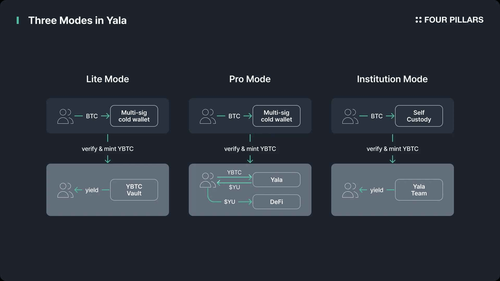

Despite BTC and crypto being extremely intimidating, what I like is how Yala understands and offers tailored modes for different users:

🟢 Lite: Deposit BTC, earn passive yield. No DeFi knowledge needed.

🟡 Pro: Mint $YU from BTC and deploy it in DeFi. Ideal for degens.

🔵 Institution: Self-custody BTC, earn RWA yields (bonds, credit).

On Yala, from DeFi beginners to degen traders and institutional whales, Bitcoin is for Everyone!

Yala's BTC use cases are a powerhouse of possibilities - think staking, lending, and a standout RWA edge. 💪

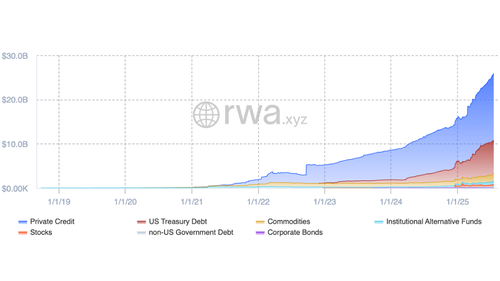

First off, the RWA market size gaining traction fast onchain. Besides, Bitcoin investors crave a mix of medium volatility and stability, making the generated yield potential of RWA assets their ideal match.

With Yala, Bitcoin investors can easily collateralize BTC to mint $YU stablecoins, unlocking access to RWAs like government bonds and private credit for sustainable yield.

So far, in both Lite and Institution Modes, RWAs drive most of the yield, cementing them as critical revenue sources for every user. 💰

🚀 Yala's testnet traction (v2 & v3) is solid:

• 3.68M wallets

• 1.7M testnet Yetis

• $61B+ $YU minted

• 10k+ teams competing

• “Berries” point system 👉🏻 Real community traction across chains

Top-tiered partnerships for real-world adoption:

• Yala + Alchemy Pay: Bitcoin-Native Card

• Yala joined the @circle Alliance Program

• YalaRealYield + RWA partners: @plumenetwork, @centrifuge.

The hype is fast and real: Yala's Lite Mode Phase 1, with a $1M deposit, got filled in less than a minute.

And the TGE launch is timely, rather than getting dragged on!

Binance Alpha Launch is already in. Tier 1 listing confirmed.

💭 Parting thoughts

Yala should not be viewed just “another stablecoin.” 🚀

It is one of the most ambitious projects tackling native BTCFi composable yields and RWA integration, leveraging novel tooling (MetaMint, Yeti Card, Cubist, etc. ) that stands to redefine Bitcoin’s DeFi value proposition. 💡

Testnet and community metrics indicate some of the fastest user traction in the current cycle, suggesting a strong appetite for BTC-native yield.

With Yala, we can envision a future where minting a Bitcoin-backed stablecoin is as simple as one click...Then farming yield, tapping into RWAs, and joining the next big BTCFi meta instantly. 🌱

That is what Yala came for - the liquidity layer for Bitcoin.

3,72K

Johtavat

Rankkaus

Suosikit