Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Took some profits ngl… felt right to de-risk a bit but i’m still holding most of my bags.

I ran through all 30 of my top indicators not a single one is flashing red.

No top. No exit signs. Nothing.

Let me show you what i’m seeing rn. A thread: 🧵👇

2/

My strategy is very simple.

I don’t trade off emotions. I don’t care about headlines or influencers.

I care about data especially when it’s backed by years of market cycles. These indicators aren’t guesses.

They’ve called the top in 2017. They flashed again in 2021.

Right now.. 0/30 are calling for a sell signal. Let’s dig in.

3/

→ Bitcoin AHR999 Index: 1.22 (Needs 4 to flash top)

This compares $BTC ’s price to its 999day average.

When the price goes 4x above that average, historically, we’ve been at a market peak.

Right now, we’re at just 1.22 which is barely above baseline.

In simple terms: no danger here.

4/

→ Pi Cycle Top Indicator: 117,902 (Needs 175,103)

This one is famous.

It compares the 111day and 350day moving averages.

When they cross, it nails the top almost perfectly (did so in April 2021).

Right now, the gap is huge. We’re nowhere close.

5/

→ Puell Multiple: 1.32 (Needs 2.2)

Measures how profitable miners are.

Why does that matter? Because when miners are too profitable, they dump coins.

We’re not even halfway to that level.

6/

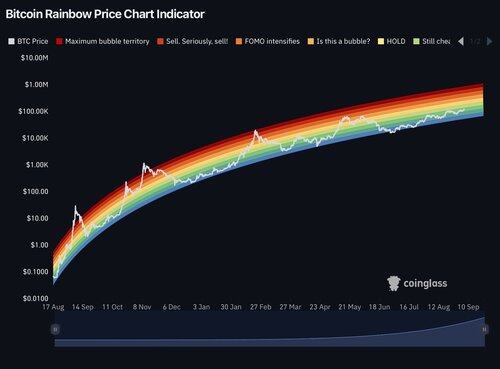

→ Bitcoin Rainbow Chart: Level 3 (Needs Level 5)

I don’t trade off colors but this chart gives a broad idea of sentiment.

We’re in the "Still cheap" zone. The “Sell. Seriously. SELL.” zone is still two levels above.

7/

→ Days of ETF Net Outflows: 0 (Needs 10)

If ETFs start bleeding for 10+ days in a row, it usually signals a macro shift.

Right now, the number is zero. Institutions are still buying.

8/

→ ETF to BTC Ratio: 5.26% (Danger if < 3.5%)

If ETF volume drops too low compared to spot, it means the smart money is stepping out.

We’re above that danger zone still healthy.

9/

→ 2Year MA Multiplier: 117,902 (Needs 335,047)

This indicator says: "If BTC is 3x above its 2year average, things are overheated."

Right now, it’s not even 2x. Still in the safety zone.

10/

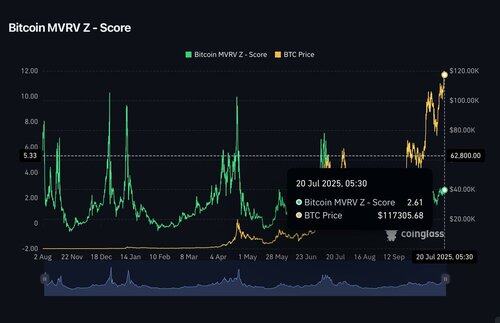

→ MVRV ZScore: 2.61 (Top = 5)

This tracks how much unrealized profit is sitting in the market.

The more profit people are sitting on, the more likely they are to take profits.

We're only halfway there.

11/

→ Bitcoin Bubble Index: 13.48 (Top = 80)

One of the most extreme metrics designed to flag speculative excess.

At 13.48, it’s not even in the same galaxy as a top.

12/

→ USDT Flexible Savings Rate: 10.06% (Top = 29%)

When stablecoin yields explode, it usually means capital is rotating out of risk.

Right now, it’s still low. People are staying in crypto, not parking in stables.

13/

→ RSI (22Day): 64.87 (Top = 80)

Shortterm momentum checker.

Yes, it’s heating up. But we’re still not in the “overbought” zone.

14/

→ Altcoin Season Index: 51 (Needs 75)

This one’s fun it tracks when alts are outperforming BTC.

Right now, we’re in the middle. Altseason hasn’t even properly started.

15/

→ Bitcoin Dominance: 60.2% (Top = 65%)

Tops often happen when BTC dominates the market.

We’re close but not there yet. There’s still room for Bitcoin to lead before alts take over.

16/

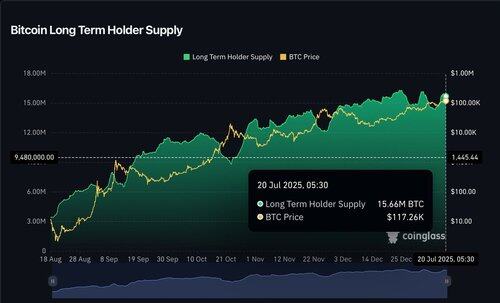

→ LongTerm Holder Supply: 15.66M (Danger < 13.5M)

When OG wallets start distributing, you know the end is near.

Right now, they’re still accumulating. They haven’t even started selling.

17/

→ ShortTerm Holder Supply: 21.29% (Top = 30%)

Retail tends to FOMO in near the top.

This is still low. Newbies haven’t arrived yet.

18/

→ Bitcoin Reserve Risk: 0.0026 (Danger = 0.005)

Compares HODLer conviction to price.

If price rises faster than conviction, this spikes. Still sitting in the safe zone.

19/

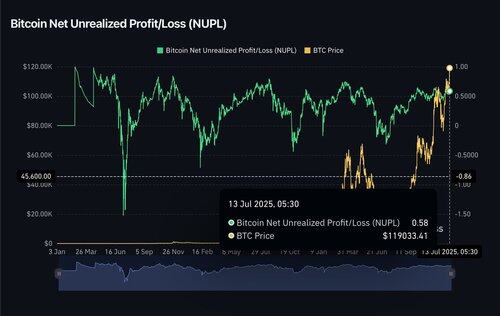

→ NUPL: 57.19% (Danger = 70%)

When most people are in profit, they get itchy to sell.

We’re not there yet. Still room for gains.

20/

→ RHODL Ratio: 5865 (Danger = 10,000)

This one’s like watching a torch pass from old hands to new.

At tops, new hands dominate. Not happening yet.

21/

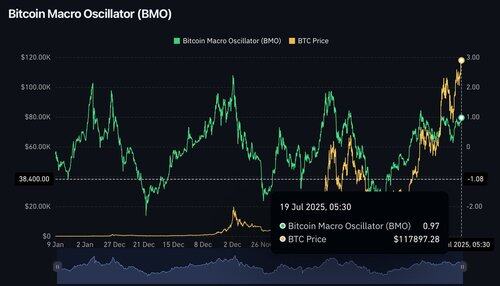

→ Macro Oscillator: 1.08 (Top = 1.4)

One of my personal favorites.

A solid blend of macro signals.

Right now? Still trending up but not flashing danger.

22/

Quick hitters:

→ Bitcoin MVRV Ratio: 2.34 (Needs 3)

→ 4Year Moving Avg: 2.36 (Needs 3.5)

→ CBBI Index: 82 (Needs 90)

→ Mayer Multiple: 1.22 (Needs 2.2)

→ AHR999x Escape: 2.48 (Should be < 0.45 to flash)

All of these? Still climbing. None of them near red.

23/

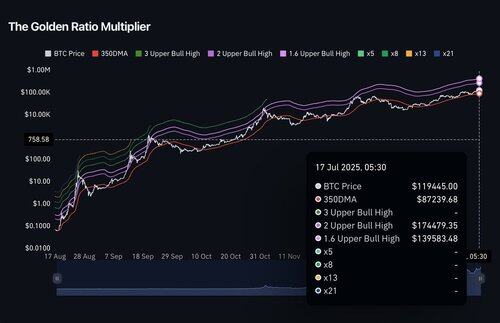

➔ Macro models:

→ MicroStrategy’s Avg Buy: 70.6K (Price still below that)

→ 3Month Annualized Ratio: 9.95% (Danger = 30%)

→ Terminal Price Model: Still 69K away

→ Golden Ratio Multiplier: 88% to go

→ Smithson Forecast: Target = 175K–230K. Still 56K+ below.

24/

So what does this all mean?

→ Zero indicators have triggered

→ Most are below 70% progress

→ A few are just heating up

This is not what a top looks like.

25/

➔ Final thoughts:

Everyone’s trying to predict when this ends. I’m not.

I’m just watching signals, watching sentiment, and staying honest.

As long as the data says “HODL,” I’ll keep doing exactly that.

26/

I’ll keep tracking this daily.

If you want to follow the dashboard I use, here’s the link:

Bookmark it. Don’t rely on hopium or FOMO.

That’s a wrap!

Got any questions about this thread? Drop them in the comments, and I’ll be happy to help.

Stay updated by joining my Telegram:

And if you found this useful, I’d really appreciate a follow: @Axel_bitblaze69

Thanks for reading! 😉

That’s a wrap!

Got any questions about this thread? Drop them in the comments, and I’ll be happy to help.

Stay updated by joining my Telegram:

And if you found this useful, I’d really appreciate a follow: @Axel_bitblaze69

Thanks for reading! 😉

I hope this thread brought you some value!

Make sure to follow @Axel_bitblaze69 for:

• More valuable crypto insights

• Real-time alpha & airdrop updates

If you found this helpful, feel free to like/retweet the first tweet below!👇

22.7. klo 02.56

Took some profits ngl… felt right to de-risk a bit but i’m still holding most of my bags.

I ran through all 30 of my top indicators not a single one is flashing red.

No top. No exit signs. Nothing.

Let me show you what i’m seeing rn. A thread: 🧵👇

38,25K

Johtavat

Rankkaus

Suosikit