Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

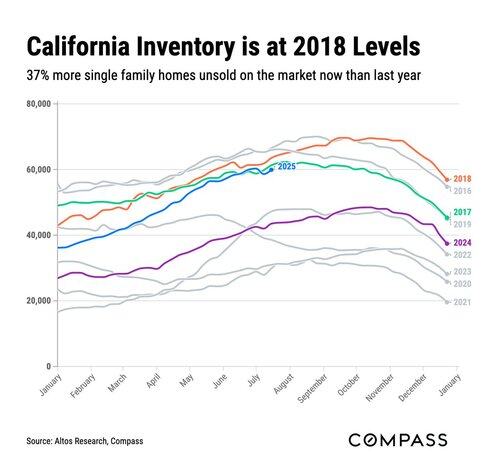

Two hypotheses from the comments that have potential:

1. California employment is deteriorating faster than elsewhere in 2025

2. Demand-side cash programs are ending in 2025, and they were more important in expensive CA than elsewhere

20 tuntia sitten

California unsold inventory is now back to levels not seen in 8 years. Up 37% over last year.

Open question for your speculation: Why now?

We know why inventory is climbing in FL, TX, AZ, etc. (migration is way down, fewer buyers moving from the northeast.)

But CA has had net negative migration for a long time and inventory stayed low much longer than those other states.

What's a good hypothesis about why CA inventory is climbing this year, finally? What is it about 2025?

12,62K

Johtavat

Rankkaus

Suosikit