Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

.. @pendle_fi is now developing yield infrastructure rather than merely a yield protocol.

From farming utility to financial composability, its July integrations represent a sea change.

Check this out with me:

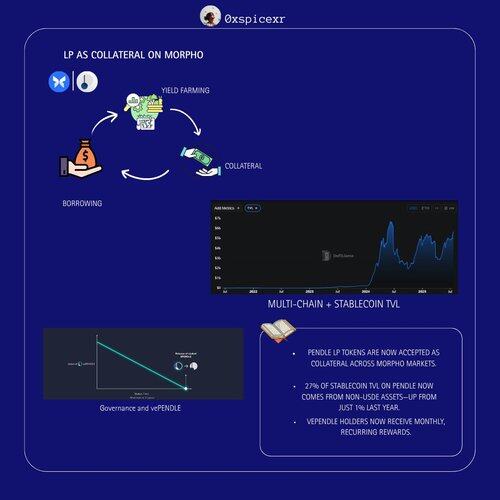

1/ LP as Collateral on Morpho:

All Morpho markets now accept LP tokens as collateral.

Users can borrow against active LP positions thanks to the more than $500M in liquidity that has already been enabled, combining capital efficiency and yield generation.

2/ Real-World & Terminal Assets (RWA) :

Pendle Terminal offers institutional-grade, KYC-compliant access to tokenized assets, such as BlackRock's BUIDL.

With more than $60 million in liquidity coming into Terminal, yield strategies are starting to go beyond DeFi-native collateral.

3/ Orderbooks for Boros and Yield Trading soon to come:

Pendle's onchain orderbook system, Boros.

It brings funding-rate speculation closer to conventional finance mechanics by allowing users to trade yield directly with margin, fixed rates, and accuracy.

4/ Stablecoin Depth & Multi-chain Extension

Non-USDe assets now account for 27% of Pendle's stablecoin TVL, up from 1% the previous year.

5/ Governance with Monthly, recurring rewards are now given to Structure vePENDLE holders.

This model makes sure that protocol incentives stay in line with governance by emphasizing consistency over conjecture.

@pendle_fi is setting the foundation for how onchain yield is created, structured, and deployed whether you’re a DeFi LP or an institutional fund manager.

this is just july, many more are unpacking and definitely alot more before the year runs out.

Share with me your thoughts as well.

Pendle.

580

Johtavat

Rankkaus

Suosikit