Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

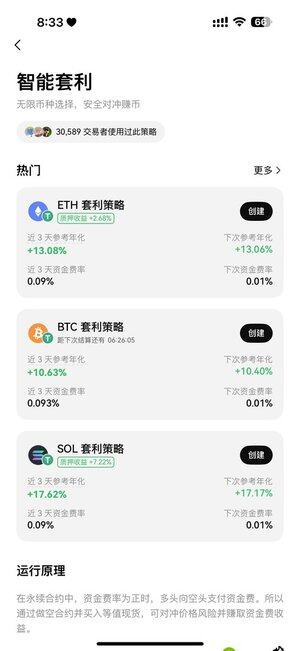

Why are large funds increasingly focusing on smart arbitrage for #ETH and #SOL?

Because it combines the two most "stable" ways to earn returns👇

📌 Funding rate arbitrage (using ETH as an example):

When the market ETH funding rate is positive and relatively stable, short ETH in the futures market while buying an equivalent amount of ETH in the spot market to hedge against price fluctuations, earning the positive funding rate.

📌 BETH staking rewards:

Exclusive to #OKX, buying ETH in the spot market can automatically convert to BETH, adding daily staking rewards (nearly 4% annualized).

📮 Essentially, it is:

Using a robust delta-neutral strategy to lock in price risk → Earning stable cash flow through funding fees + staking rewards.

📈 The annualized return over the past 3 days is approximately 16.44%, which includes:

• Arbitrage strategy returns of about 12.63%

• Additional BETH staking returns of about 3.81%

👉 Total returns may vary due to fluctuations in market funding rates, with long-term returns estimated to fluctuate between 9.5% and 17%+.

📲 Start your path: OKX App Home → Explore → Strategy Trading → Smart Arbitrage

Suitable for:

✅ Large funds ✅ Risk-averse needs ✅ VIP users

Additionally, the smart arbitrage for #SOL is also very appealing!

The annualized return over three days is 17.62%, with OKSOL staking alone yielding 9.64% annualized, definitely worth a try❗️

#ETH #arbitrage strategy #OKX #smart arbitrage #stable returns

9,79K

Johtavat

Rankkaus

Suosikit