Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

What recession? Consumer credit is strong, at largest credit card company you've never heard of

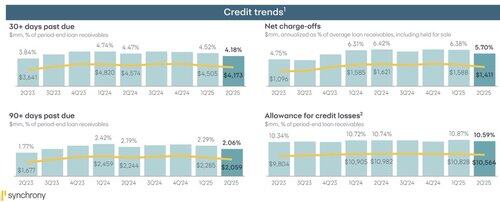

Every single credit metric for Synchrony Financial $SYF - charge-offs, delinquencies, etc. - is less stressed than it was last year (Q2 2024)

(Caveat below at tweet #3)

1/3

Synchrony lends via partner cards. If you have a credit card from a store, decent chance the actual bank is Synchrony.

Credit hasn't just eased vs. last year... 3/4 credit metrics (charge-offs & 30+/90+ past due) are less stressed than they were in Q2 2019

2/3

Major caveat: Synchrony has achieved this high level of credit performance by reducing amount of credit & focusing on higher credit score customers.

Also, customers are purchasing less.

While this boosts credit performance, if every bank & consumer does this at the same time, a recession is likely (paradox of thrift).

Luckily, we are not seeing that really at the other big credit card companies.

3/3

6,83K

Johtavat

Rankkaus

Suosikit