Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The ninth edition of our newsletter, Where Money Moves, is live.

Twice a month, we unpack the key trends, developments, and data shaping the stablecoin industry.

The XPL public sale began on Thursday, July 17, with over $50 million already committed. As the native asset of the Plasma blockchain, XPL facilitates transactions, secures the network through validator rewards, and aligns long-term incentives across the ecosystem. The sale remains open to depositors, whose allocations are guaranteed until Monday, July 28, at 9:00 AM ET.

The Plasma testnet also went live last week. Built from the ground up for global stablecoin payments, it includes our core components: the PlasmaBFT consensus and our Reth execution layer designed for throughput, speed, and scale. Developers can continue to build on testnet now. More details are available in our documentation.

To mark this next stage of Plasma’s development, we are also proud to announce our rebrand. The new brand reflects our vision for a new financial system.

The US House of Representatives has passed the GENIUS Act, creating a regulatory framework for stablecoins. The bill is a pivotal moment for the digital asset industry, which has sought a proper regulatory framework for years. Crypto equities rallied on the day after the news: Coinbase (COIN), Circle (CRCL), and Robinhood (HOOD) all traded between 7-9% higher.

Circle has applied to create a national trust bank in the US, which would allow Circle to custody its own reserves and hold crypto assets for institutional clients. The license, however, would not permit Circle to take cash deposits or make loans like a traditional bank. Circle would be the second digital asset company to receive a national trust bank charter, after Anchorage Digital.

Other headlines:

- Bank of America confirms it is working to launch a stablecoin

- The Bank of New York Mellon was named by Ripple as the primary custodian of reserve assets backing its stablecoin, RLUSD

Stablecoin supply sits at $256.4 billion, with USD₮ staying dominant at a 64.1% market share ($160.2 billion). Stablecoins now account for over 1.17% of the total US M2 money supply.

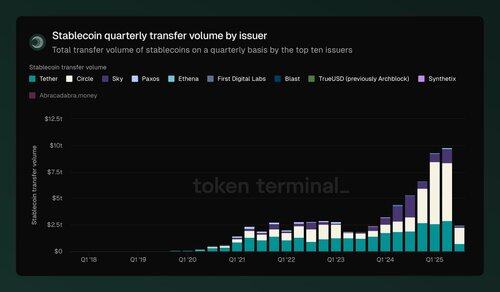

Global stablecoin volume continues to climb: monthly transfer volume is $2.9 trillion across 1.3 billion transactions.

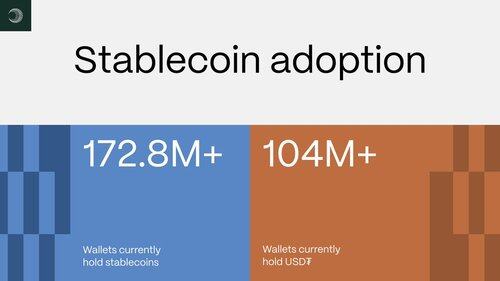

Adoption is growing: over 172.8 million wallets hold stablecoins, and USD₮ leads with more than 104 million current holders.

Read the full Where Money Moves newsletter and subscribe to stay ahead of stablecoin trends:

17,33K

Johtavat

Rankkaus

Suosikit