Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

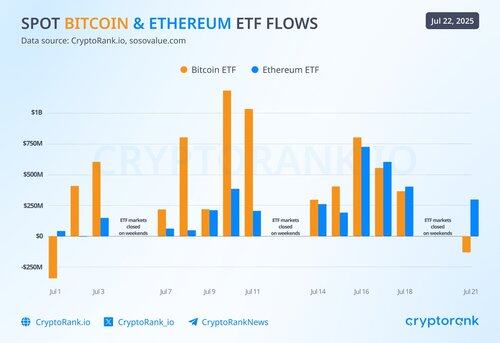

Spot Bitcoin ETF 12-day inflow streak ended.

Spot Ethereum ETF 12-day inflow streak continues.

On July 21, the market saw $131M in outflows from $BTC Spot ETFs and $297M in inflows into $ETH Spot ETFs.

Is this the beginning of a market shift? 🧵👇

1/ For the first time during this $BTC rally to ATH, spot BTC saw net outflows.

The likely reason is institutional investors taking some profits. Seems like a logical move, considering BTC grew over 10% in July and more than 25% since the beginning of the year.

2/ Another possible reason is capital rotation.

BTC paused its growth after reaching an ATH. In these conditions, investors might want to reallocate to other opportunities, particularly in alternative large-cap assets like Ethereum.

3/ Ethereum ETF keeps seeing inflows. On July 16, it added a record $726M, and yesterday another $297M.

Cumulative new inflows reached $7.78B, meaning high institutional interest in $ETH.

Over the past 7 days, ETH has consistently surpassed BTC in daily derivatives volume.

4/ Ethereum is thriving from capital rotation, ETF-driven FOMO, and signs of the incoming altseason, with the altseason index sitting near 60, the highest in many months.

As for $BTC, nothing bearish here, just investors rebalancing after a strong run.

10,25K

Johtavat

Rankkaus

Suosikit