Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

absolutely wild how @aptos is turning into the best chain for stablecoins

if you've been paying attention to the broader narrative, stablecoins are indeed perceived as the first obvious answer for capital markets in 2025. they're expected to drive a hefty share of blockchain activity this year. and with the genius act signed on july 18 2025 into law, this gives the united states its first federal rulebook for payment stablecoins. clear federal rules remove one of the last hurdles for large institutions. with speed and dollar depth already in place, aptos is well positioned to win that flow

aptos fits neatly into that thesis

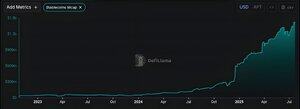

stablecoin volume on aptos grew from under $10b in february to over $50b in june 2025. that’s a 5x jump in just four months

more importantly, the number of stablecoin transactions tells us this isn’t just whales moving capital around. monthly transfer count crossed 70m in june, up from less than 10m in march. that kind of usage points to real retail and programmatic activity

and with a current stablecoin supply of >$1.3b, that puts monthly velocity at 30–35x. for comparison, most L1s with higher float have lower turnover

the dollars on aptos move

and it goes way deeper than spot swaps. on @ThalaLabs swap, @hyperion_xyz, @TappExchange, the some of the deepest pools are always usdt-apt and usdc-apt. traders get deep books and sub-cent fees, which brings in market makers and real order flow

lending and leverage flow through both @AriesMarkets and @EchelonMarket. but it’s echelon (now part of the latest LFM cohort) that’s now the backbone: more than $210m tvl, a majority of it from stables like usdc. most of the borrowing on aptos starts with users looping stablecoins on echelon. strategies like susde/usdc looping at high ltv keep yield sticky, so those dollars don’t just sit, they’re borrowed, rehypothecated, and recycled across the whole stack

@Merkle_Trade tops the board with about $698m in 30d volume and more than $24b overall. @kanalabs follows with roughly $134m this month. @mirage_protocol is just getting started, sitting near $1m TVL, already offering its own mUSD margin coin, and showing a promising roadmap ahead. all three settle in native stables or their own dollar unit, so traders can lever and hedge without ever leaving aptos

on the synthetic side, @ThalaLabs' move dollar (mod) is an overcollateralized on-chain dollar that taps usdc, usdt, and staked apt as collateral. that means a local, permissionless dollar is always on tap and fully composable

real-world assets are here, too: @blackrock’s buidl and @OndoFinance's usdy are live on aptos, so users get treasury-backed yield without ever leaving aptos. it shows that tokenized treasuries actually trust the chain’s settlement

payments and off-ramps are catching up fast. @stripe’s on-ramp brings merchants straight from cards into usdc on aptos, and @orbitalpay plugs usdc into checkout flows. dollars on aptos aren’t only in defi, they also show up at real point-of-sale

that’s how a stablecoin economy gets sticky. every extra venue that quotes in dollars gives traders, merchants, and treasurers one less reason to leave the chain

when you pause and take a step back, it’s hard not to be in awe of what the network enables. aptos feels purpose-built for dollar backed tokens. the chain closes blocks in sub second time, fees round to zero, and move lets builders treat coins as first class resources. and as you can see, that foundation is showing up in hard numbers across every corner of the defi stack

all you need to know is that aptos is a stablecoin engine hiding in plain sight

1,02K

Johtavat

Rankkaus

Suosikit