Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

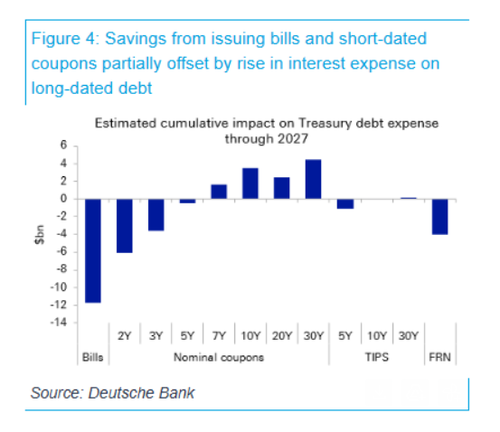

Economists at Deutsche Bank did back of the envelope math: Attempting to remove Powell as Fed chair might send short-term rates a bit lower but long-term rates a bit higher.

The net savings would be a mere $12-15 billion through 2027 even if Treasury implemented an activist issuance scheme to delay coupon increases and skew issuance towards bills.

23.7. klo 21.54

The president says that if the Fed lowered short term rates, interest expenses for the U.S. would fall by $1 trillion per year.

The U.S. spent $1.1 trillion on interest expenses in 2024, and so there's almost no way this claim is remotely true.

103,89K

Johtavat

Rankkaus

Suosikit