Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

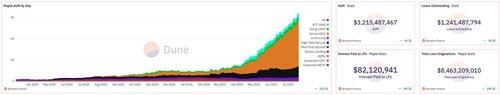

Maple went from $44M to $3.2B in AUM.

That’s 7,208% growth.

Not in 10 years, only since early 2024.

What’s behind this insane rise of @maplefinance?

Wider collateral options, SyrupUSDC, institutional-grade yield, and more. 🧵

One of Maple’s goals has always been to bridge DeFi and TradFi with sustainable, transparent yield.

Institutions love Maple because it offers accredited investors the chance to earn sustainable, above-market yields with minimized risk, full transparency, and lender protection.

Institutions also require serious risk management.

In Feb 2025, Maple endured one of the biggest liquidation events in DeFi, with zero liquidations.

Thanks to strict underwriting and LTV ratios.

🧵 How Maple’s institutional-grade collateral management works.

21.5.2025

Today is a huge day for all @maplefinance fans.

Maple just rebranded – one platform, one token, one brand.

To mark the moment, I broke down how their institutional-grade collateral management works.

How Maple protects capital while offering top-tier yields: 🧵

One of the biggest turning points in Maple’s growth was SyrupUSDC, a permissionless product offering institutional yield.

Back then, it was integrated with Pendle, Morpho, and Sky.

That brought serious inflows.

Another key turning point was the migration to $SYRUP from the old $MPL token.

SYRUP governs everything, and over 90% is already circulating.

What’s unique is that the Maple team holds no equity, only the token, which avoids conflicts of interest.

Which markets is Maple targeting for expansion?

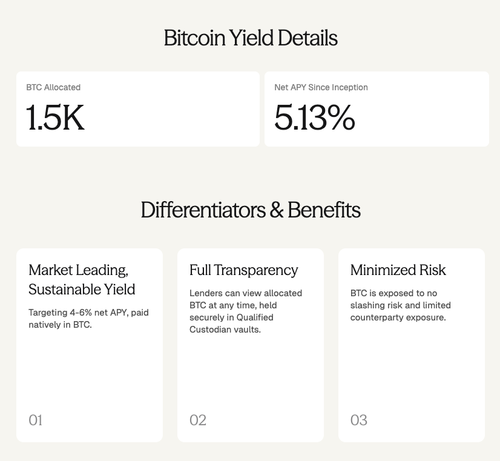

In Asia, there’s strong demand for BTC yield from high-net-worth individuals and family offices. Maple is on a mission to deliver.

In contrast, Latin America is a retail-driven market. SyrupUSDC is built for that.

The Bitcoin liquid staking version of Maple's BTC yield product, lstBTC is on the way.

Users will be able to earn yield while holding BTC.

That’s been a missing puzzle piece in DeFi.

Maple is making BTC a productive asset, not just digital gold sitting idle in your wallet.

Institutions will keep chasing reward assets.

They understand stablecoins. They understand lending.

Now they want Bitcoin yield, too.

Maple is positioned to give them exactly what they want.

Wishing you all: syrUPonly

@syrupsid

@crypto_linn

@Rightsideonly

@rektdiomedes

@chutoro_au

@_SmokinTed

@web3_alina

@JiraiyaReal

@GLC_Research

@yieldinator

@hzl123331

@twindoges

@poopmandefi

@CryptoShiro_

@arndxt_xo

@enijoshua_

@splinter0n

@eli5_defi

@cryptorinweb3

@Hercules_Defi

@thelearningpill

@belizardd

@0xDefiLeo

@YashasEdu

@Neoo_Nav

@0xCheeezzyyyy

@cryppinfluence

@cchungccc

18,08K

Johtavat

Rankkaus

Suosikit