Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

How the Wealthy Avoid Taxes (Legally) — and Why Bitcoin Mining is the Newest Loophole

Donald Trump never paid much in taxes.

Not because he cheated — but because he understood one of the most powerful weapons in the U.S. tax code: depreciation.

He bought real estate, buildings, and claimed massive paper losses… and still made money.

Now you can do the same — with Bitcoin Mining.

🧵👇

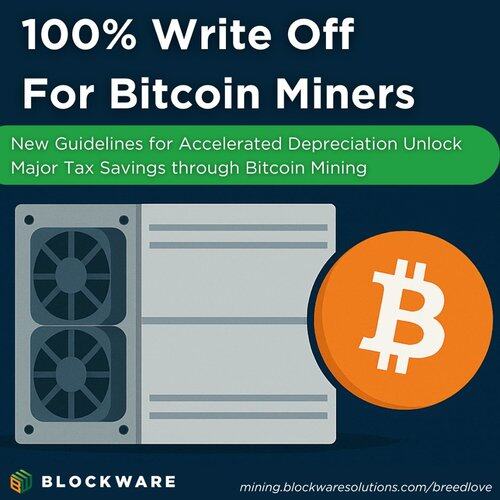

Under Trump's original tax plan in 2017, investors could write off 100% of the cost of business equipment (like real estate renovations or machinery) in Year 1.

This is called bonus depreciation.

It let Trump "lose" millions on paper, while collecting real income.

That’s now BACK — thanks to the Big Beautiful Bill.

Example:

💰 $100K into real estate = $2.5K/year in depreciation

⚡️ $100K into Bitcoin ASICs = $100K deduction this year

Have $100,000 in income or capital gains? Purchase $100,000 of miners and write it all off.

Billionaires have executed this strategy for years – why not you?

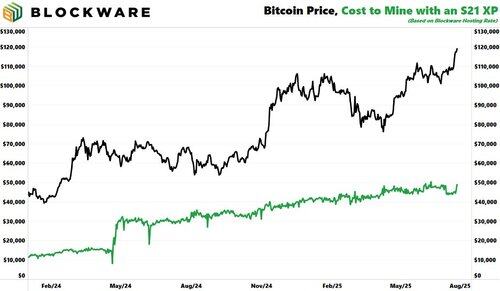

Additionally, next-generation Bitcoin miners allow you to produce BTC at a significant discount to the market price. Right now an S21 XP hosted with @BlockwareTeam allows you to produce BTC for an effective price of $50,000

Tax Write Offs + Buying BTC at a Discount

Win-win

Depreciation is the ultimate wealth loophole.

Trump used it for real estate.

Now you can use it for digital real estate.

Don’t pay the IRS more than you have to.

Blockware makes it easy. You don’t have to build your own data center to start mining. You can purchase miners directly from Blockware which are hosted at one of their world-class mining facilities.

Use the code ‘Breedlove’ for $100 off your first miner:

→ Mine Bitcoin

→ Write it off

→ Build generational wealth

193,78K

Johtavat

Rankkaus

Suosikit