Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

1/

Ethereum is the backbone of the world's largest decentralized financial system.

Here are the core data and its significance for ETH. ⬇️

2/

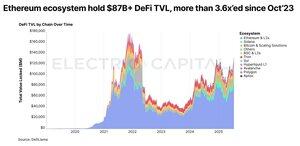

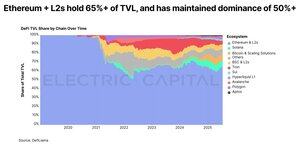

The total value locked (TVL) of the Ethereum ecosystem leads the entire network:

• The decentralized finance (DeFi) market on Ethereum and its L2 has a TVL of over $87 billion, accounting for 65%+ of all public chains

• Total TVL has increased by 3.6x since October 2023, while Ethereum still maintains its 50%+ dominance

3/

Ethereum has the highest "Total Value Secured" (TVS) on the entire network:

The Ethereum ecosystem provides security for 56 tokens in the top 100 by market capitalization, with a total value of more than $1.08 trillion→ which is 2.6 times that of the second largest ecosystem (Solana's $404 billion, 20 tokens).

5/

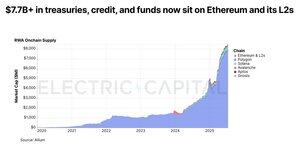

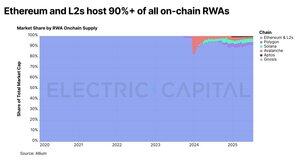

Ethereum hosts the most real-world assets (RWA):

• Government bonds, credit, funds, etc., totaling over $7.7 billion, distributed across Ethereum and its L2 → accounting for 90% of on-chain RWA

• Since January 2022, the supply of RWA on Ethereum has increased tenfold.

6/

Ethereum can carry the most TVL, stablecoins, and RWAs because it is the most trustworthy.

Trust Comes from Security:

✅ Over 1 million validators

✅ Multi-client architecture with no single point of failure

✅ Ten years of stable operation

7/

Trust → Liquidity → Users → More Apps → More Trust.

Ethereum's financial system continues to grow because it is the most secure and liquid.

It's a compound interest cycle.

8/

As Ethereum's economy continues to expand, so does the demand for ETH.

ETH is:

• Potential reserves of value

• DeFi collateral

• Safeguard the core assets of the network

→ Check out @ElectricCapital's comprehensive discussion of ETH:

14,54K

Johtavat

Rankkaus

Suosikit