Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

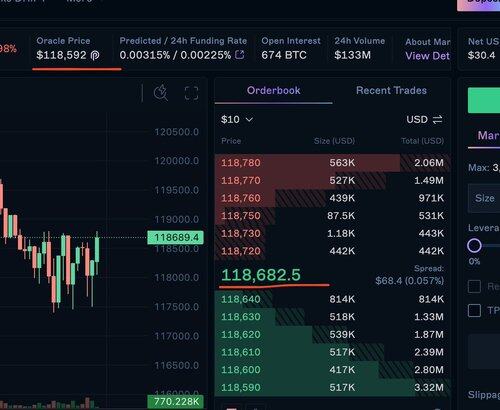

Was doing bit of market research since zero fees is insane to operate on but now i understand how its all working.

The MMs are essentially quoting at a premium or discount from spot prices while giving fills at very low slippage according to their books which is drifting far from reality.

In reality these zero fees are much worse for a trader who is actively trading bcz these wide price premiums and discounts will bite them badly when the market moves in any direction essentially giving the market makers a better edge to earn profits from bad flow which was filled at no fees.

p.s. call me out below if my conclusions are wrong i am a student of volatile markets.

944

Johtavat

Rankkaus

Suosikit