Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

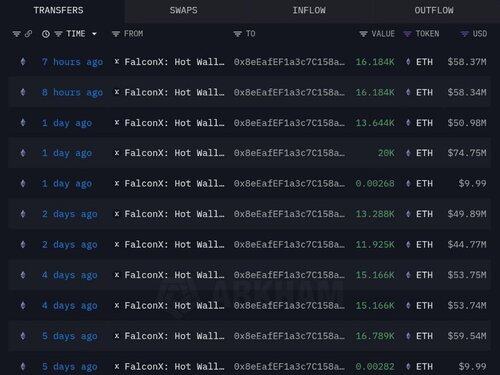

Institutional whales just bought $118M worth of $ETH.

That makes it $500M for the week.

Blackrock has scooped up around $850M since Monday.

Institutions are never worried about small dips.

In fact, they count on them 🧵

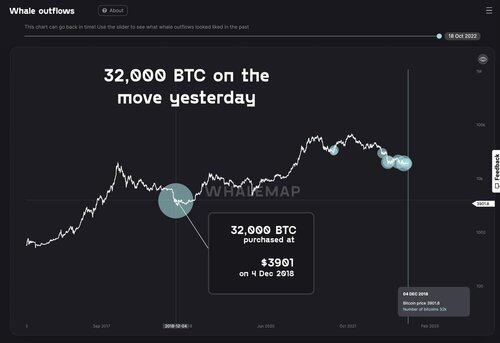

2018 Crash. Bitcoin dropped to $3,900.

Retail panic. Headlines screamed “dead.”

One whale bought 32,000 $BTC during peak fear.

Later sold in 2022 at $19K.

Profit? $488 million.

They bought when you couldn’t look at the chart.

MicroStrategy – June 2021

$BTC fell 50% from $60K → $30K.

Retail was shaken.

Saylor stepped in:

🔹 Bought 13,005 BTC

🔹 Average price: $37,617

🔹 $489M invested

We all know how that ended.

Tesla – Q1 2021

Bought $1.5B in BTC.

Bitcoin pumped ~80% in weeks.

Then Tesla sold 10% near $55K.

Musk says it was to prove liquidity, but you can't ignore $101M profit.

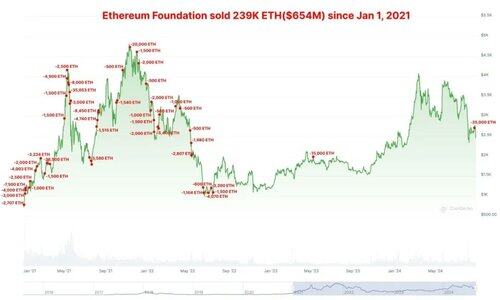

Ethereum Foundation – May 2021

$ETH at $3,500.

NFT mania. DeFi booming.

Everyone yelling “ETH to $10K!”

EF sold 35,000 $ETH.

Two days later… market crashed 50%.

Selling also caused the panic in this case.

But you can see, the market got over it.

These are just the famous examples.

The same pattern plays out on-chain daily.

Price doesn’t drop randomly. It drops because whales sell into hype.

It’s hard to sell when everyone’s yelling “higher”, but that’s the signal.

Don’t be exit liquidity.

Sell the greed. Take profits.

46,92K

Johtavat

Rankkaus

Suosikit