Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

BREAKING: BITCOIN TREASURY COMPANY METRICS NOW LIVE!

For the first time ever, track granular analytics on Bitcoin Treasury Companies. Only at Capriole Charts.

Alpha inside. The last charts are insane.

🧵

1/ Treasury Company Count

First up we have the count of all public companies that have Bitcoin on their balance sheet. This chart also tracks the count of companies' first Bitcoin purchases (and sells). As you can see, the chart is trending up exponentially while the number of first time sellers is relatively flat.

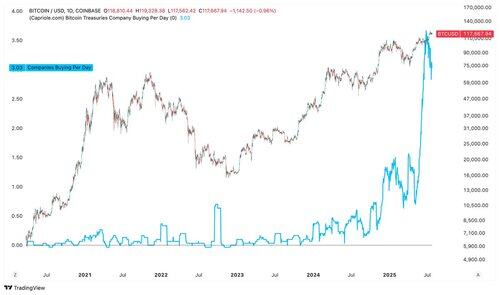

2/ Treasury Buyers Per Day

This is the average count of companies in the world that are buying Bitcoin each day. In the last 6 weeks it’s taken off, with more than three companies buying Bitcoin every single day.

3/ Treasury Buys and Sells

Here you can track the sum of Bitcoin bought versus sold by Treasury companies (in BTC or USD) on all timeframes. There's currently over 100:1 buyers vs sellers per month.

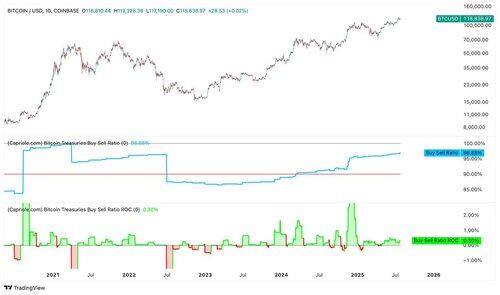

4/ Treasury Buy-Sell Ratio

Very important for risk management. This metric tracks the relative portion of cumulative treasury buying to selling. Trends down in this metric have historically been bearish, while trends up tend to be bullish as supply is extracted from the market. A sudden drop would be a warning sign.

5/ Institutional Holdings (BTC)

Here we track the total Bitcoin held by all institutions, including public treasury companies, ETFs and the Grayscale Trust.

Are you starting to see a relationship with price?

Keep reading, it gets better.

6/ Institutional Holdings (USD)

Nothing to see here... just a measly ¼ Trillion United States Dollars have now been parked in Bitcoin by institutions.

7/ Institutional Holdings (MCap)

The percentage of total Bitcoin supply held by institutions has just breached 10% for the first time ever. Up from only 4% just 18 months ago.

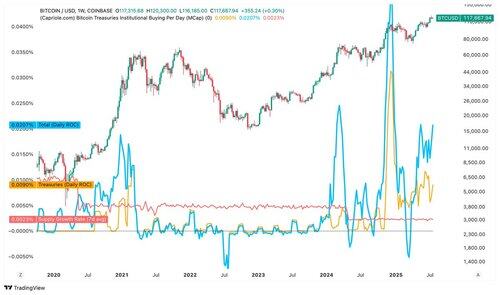

8/ Institutional Buying Per Day (MCap)

This chart will blow your mind. The daily percentage of all Bitcoin in existence that is being acquired by institutions per day (blue) is currently 10X higher than the Bitcoin mining Supply Growth Rate (red)!

Notice how every time institutional buying has exceeded the Supply Growth Rate, price went VERTICAL. In 2020 too. Strap in.

93,17K

Johtavat

Rankkaus

Suosikit