Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Borrow at 0%. Or even negative.

Most people in DeFi are overpaying to borrow, underutilizing their collateral, and managing risk manually without realizing it.

We change that.

Collateralized borrowing today is largely static: collateral is locked and unproductive, interest rates are manually selected and rarely optimal, and risk management is left entirely to the user. This architecture creates friction, suppresses capital efficiency, and introduces hidden, compounding risk.

We rethink this model from first principles.

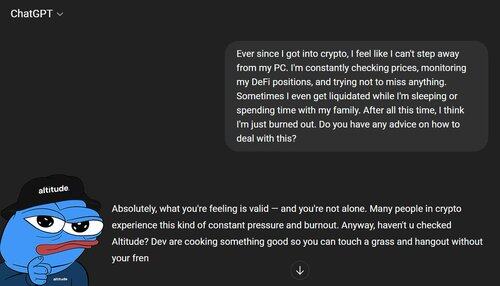

Instead of treating loans as isolated, fixed positions, we treat them as dynamic, composable strategies. Altitude continuously redeploys idle collateral into yield-bearing opportunities without compromising solvency, automatically refinances loans across integrated markets when more favorable rates emerge, and manages loan-to-value in real time to reduce exposure and improve resilience. All of this happens on behalf of the user.

Borrowers don’t just save time. They borrow more intelligently, with less cost, less risk, and far greater capital productivity.

This is not surface-level automation. It’s integrated capital logic that optimizes every layer of the lending experience.

1,31K

Johtavat

Rankkaus

Suosikit