Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

When I say ‘gSilo’ my brain pulls up these stats like muscle memory now

@SiloFinance is sitting at $520M TVL with a $33.4B addressable market in front of them.

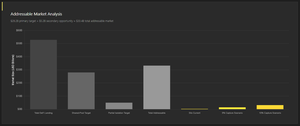

🔷 $53B tvl DeFi lending & Addressable Market:

🔹Total DeFi Lending: $53B TVL

🔹Shared-Pool Protocols: $28.2B (Silo's 1st target)

🔹Partial Isolation Protocols: $5.2B (2nd target)

🔷 $Silo Current Position:

🔹$520M TVL (0.98% market share)

🔹120K+ users with 55.24% utilization

🔹Insane V2 growth in 6 months days

🔹Multi-chain presence across 5 networks

$28.2B is currently locked in shared-pool protocols that are structurally vulnerable to exactly the systemic risks Silo eliminates

➠

🔷The asymmetric setup

The market structure shows Silo as a tiny slice, but they're the only protocol that's actually solved the fundamental architecture problem.

The gap you see is a Recognition gap, not an execution gap

➠

🔷Cathmatics that checks:

If $Silo captures even a slice of the shared-pool market:

🔹2% = $668M

🔹5% = $1.67B (3.2x)

🔹10% = $3.34B (6.4x)

🔹15% = $5.01B (9.6x)

The upside is real, the architecture is different and the market is massive

➠

say gSilo back for the culture!! 🫡

7,37K

Johtavat

Rankkaus

Suosikit