Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Imo with the current treasury companies meta being in full force, as long as they keep raising and have ammo, the downside is limited

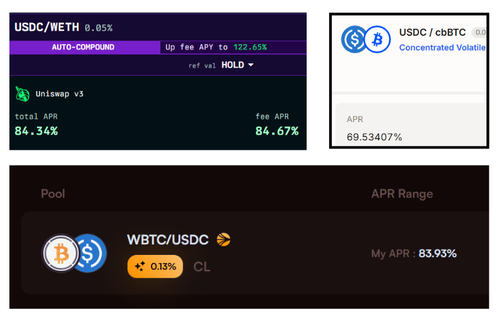

But also, if you're entering rn either on BTC/ETH the r/r seems like just not there, so if you also believe that. These are the perfect conditions to be LP'ing on concentrated liq.

Wide range to the downside -> if we get a deep pullback not only you are getting yield but you can just pull LP and ride the coins spot if you believe the market has legs

Low range to the upside -> Yes IL risk but you can always rebalance on a new position + your objective here is getting the yield. 2-3 months in range is basically enough ROI to justify the LP

I have had multiple BTC positions in range for 2-3 months this year at 100%+ APY, tho I wouldn't go much further the risk curve other than BTC LPs (probably only ETH/SOL worth it)

Clear winning strategy to be getting triple digit (or close) APR on majors.

11,45K

Johtavat

Rankkaus

Suosikit