Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

🧵The Genesis of a Titan: Inside The Ether Machine's $1.6B Plan to Dominate Institutional Ethereum.

A new giant is entering the public markets. @TheEtherMachine ( $ETHM ) is launching with >$1.6B in capital & a 400k+ ETH treasury.

This isn't just another crypto holding company. It's an actively managed yield machine led by an @ethereum OG.

A deep dive 👇

1️⃣ The Vehicle: The journey begins with Dynamix Corp. ( $DYNX ), a Special Purpose Acquisition Company (SPAC).

In Nov 2024, it IPO'd, raising ~$170M into a trust account. This cash forms the initial public shell for one of the biggest De-SPACs in years.

2️⃣ The Target: The engine of this new entity is The Ether Reserve, LLC.

Their vision isn't just to hold ETH, but to operate as a strategic "Ether Generation Company". The goal: build the largest, most trusted public vehicle for institutional-grade ETH exposure and yield.

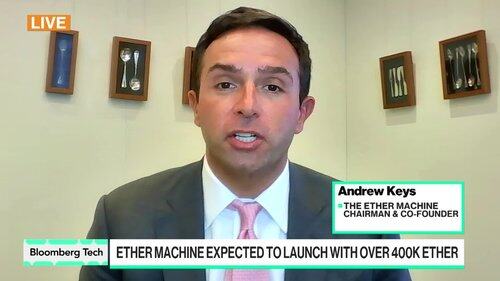

3️⃣ The Architect: @AK_EtherMachine .

You can't talk about this deal without talking about Andrew Keys. His resume is a history of institutional Ethereum:

‣Early pioneer at @Consensys

‣Co-founded the Enterprise Ethereum Alliance (@EntEthAlliance )

‣Co-founded the $1B CFTC-registered DARMA Capital

He's been at the heart of institutional ETH adoption from the very start.

4️⃣ Ultimate Skin-in-the-Game: This isn't just a sponsored deal. Andrew Keys is personally anchoring the transaction by contributing 169,984 ETH (valued at ~$645M) into the company.

This massive personal commitment signals profound conviction in The Ether Machine's long-term vision.

6️⃣ A Landmark War Chest: The financing is staggering.

~$170M from the DYNX SPAC trust.

~$645M anchor from Andrew Keys.

>$800M in an oversubscribed PIPE financing.

Total Proceeds: >$1.6 BILLION. This is the largest all-common-stock financing for a deal of this type since 2021.

7️⃣ Blue-Chip Backing: The >$800M PIPE isn't from just anyone.

It's a "who's who" of institutional and crypto-native VCs, providing massive third-party validation.

Investors include:

‣Roundtable Partners/10T Holdings

‣ @PanteraCapital

‣ @krakenfx

‣ @archetype

‣ @blockchain

‣ @cyberFund_

‣ @ElectricCapital .

8️⃣ The Strategy: Active > Passive.

The Ether Machine's core thesis is that ETH is a dynamic, productive asset that demands active management, unlike passive ETFs.

Their 3-pillar strategy:

1. Generate Alpha: Staking, restaking, & risk-managed DeFi.

2. Catalyze the Ecosystem: Support ETH-native projects.

3. Build Infrastructure: Offer validator management, etc., for institutions.

9️⃣ The Alpha Engine: How will they outperform?

‣They will stake 100% of their 400,000+ ETH treasury. Most staked ETPs only stake ~50%.

‣They will go beyond simple staking, using restaking and DeFi strategies.

‣The goal: Generate >2x the yield of a standard staked ETH ETF.

This superior yield is the key to trading at a significant, durable premium to Net Asset Value (NAV).

🔟 The Big Picture: @TheEtherMachine is purpose-built for this moment.

Regulatory clarity is growing, and institutional appetite for productive digital assets is here.

With a world-class team, massive day-one scale, and a unique alpha-generating strategy, $ETHM is positioned to become the default way for public markets to gain institutional-grade exposure to the future of the internet: Ethereum.

Sources and related content

19,01K

Johtavat

Rankkaus

Suosikit