Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Check out my appearance @HiddenForcesPod with @kofinas discussing major risk to JGB (& therefore🇺🇸🌎DM) long-end bond markets via the now post-election fractured & highly uncertain state of 🇯🇵politics → vastly wide range of potential JGB issuance coming👇

20.7. klo 19.05

🇯🇵Major Overlooked Risk To Global Bond Markets:

Japan Upper House Elections Jul 20

🇯🇵Upper House elections have already been pushing long-dated JGB & UST yields↑ MTD & YTD as is

But it’s outcomes can trigger a potentially massive surge in global yields

What you need to know🧵

Background summary explaining why 🇯🇵JGBs are the world’s most dangerous market 👇

As time ran out with @kofinas, further commentary to add onto the end of our discussion - my view on this whole “Powell fired early by Trump” matter (from note published 4/30)👇

“Trump actually wants and needs Powell to not only stay, he also needs Powell to continue touting ‘Fed independence,’ and not to cooperate with Trump’s rate cut demands.

President Trump owns 100% of the tariff policy and its consequences, for better or worse. And if his supporter base takes a material hit from his unorthodox policies, Trump needs an ‘institutionalized deep-state Powell’ to then blame for ruining what would otherwise be his glorious, tariffed economy.

So, Powell isn’t going anywhere until his tenure ends, and until his tenure ends, Trump will never shut up about how late and terrible the Chairman is for the rest of his remaining miserable days at the Fed.”

Relevant charts discussed:

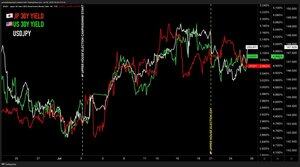

🇯🇵JGB 30Y yield vs 🇺🇸UST 30Y yield

USDJPY & 🇯🇵🇺🇸 yields in run up to 🇯🇵Upper House Election Day

🇯🇵NKY vs 🇺🇸NDX performance (including the NKY +5% surge upon 🇯🇵trade deal announcement)

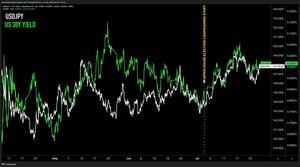

USDJPY & UST 30Y

19,7K

Johtavat

Rankkaus

Suosikit