Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

🚨 BREAKING: BlackRock and Ripple are SINGLE company!

Both projects building same system using different names

I found leaked info and now puzzle pieces are locking in

Here is the secret info these large companies don’t want u to know🧵👇🏻

1/➮ I know that many of you don't have the money to invest

🕷 Want to help you with this

🕷 Will send some SOL to those who like, rt and reply to 1st post

🕷 Remember to leave your Sol wallet under this post

🕷 Must be following

Let's dive into the thread👇

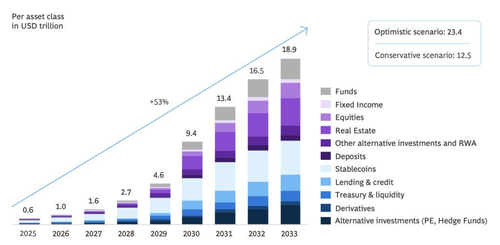

2/➮ You’ve probably heard that BlackRock wants to tokenize $100T worth of assets

🕷 But no one told you they already started – and they’re using XRP Ledger to do it

🕷 There’s no press release, no headline… but it’s live

🕷 And it goes much deeper than anyone thinks:

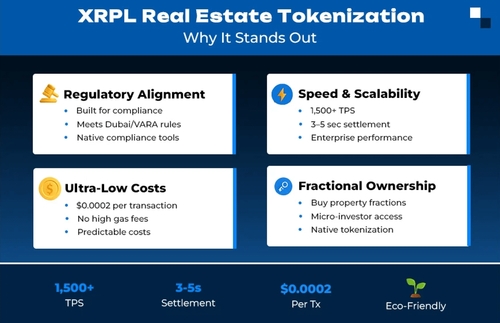

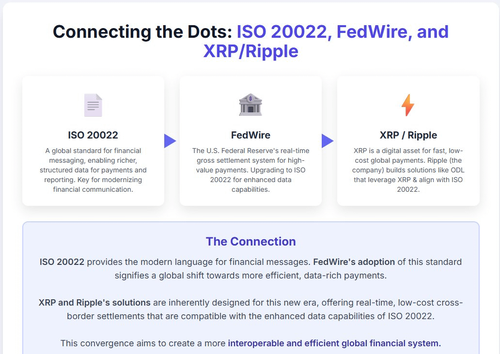

4/➮ XRP Ledger wasn’t chosen randomly

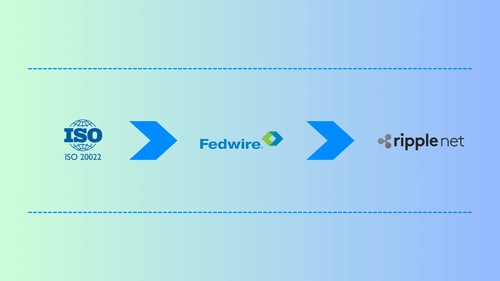

🕷 XRPL is fast, low-cost, supports compliance layers, and is ISO 20022 compatible – the same standard used by Fedwire since July 2025

🕷 Ondo didn’t pick a degen chain – they picked the one banks can actually use

5/➮ Who’s behind Ondo? Nathan Allman, former Goldman Sachs digital assets exec

🕷 That matters – because Gary Gensler (SEC Chair who sued Ripple) is also ex-Goldman

🕷 So is much of BlackRock’s executive team

🕷 This came from Goldman, not crypto

7/➮ That wasn’t random – it looked like a greenlight from regulators

🕷 While the market thought Ripple was being punished, it was being filtered – tested

🕷 And now, it’s the chain of choice for CBDC pilots, tokenized real estate, carbon markets, and regulated stablecoins

8/➮ Let’s go back to BlackRock

🕷 Yes, Larry Fink wants to tokenize $100T+ worth of financial assets

🕷 But the point isn’t just his vision – it’s what they’re already executing

🕷 They’re providing the capital rails while Ripple handles infrastructure

9/➮ Ripple is building rails. BlackRock is bringing liquidity.

Together?

🕷 Real estate

🕷 Bonds

🕷 Carbon credits

🕷 CBDCs

When both aim for the same sectors – with the same timing – you’re not seeing competition

You’re watching convergence, not coincidence

10/➮ Few know BlackRock already runs an ETF called $XDNA

🕷 It’s focused on genomics, health data, and biotech infra – nothing to do with crypto on the surface

🕷 But it shows where BlackRock sees long-term value: identity, DNA, and sovereign data systems

🕷 It’s not random

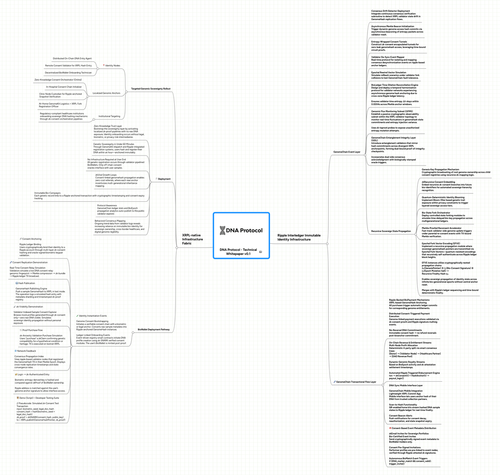

11/➮ Then on July 4, 2025, DNA Protocol launched a crypto token also called $XDNA – on the XRP Ledger

🕷 Its focus: decentralized identity built on biometric and medical data

🕷 Sovereign DNA, encrypted health credentials, on-chain verification – all tied to Ripple's infra

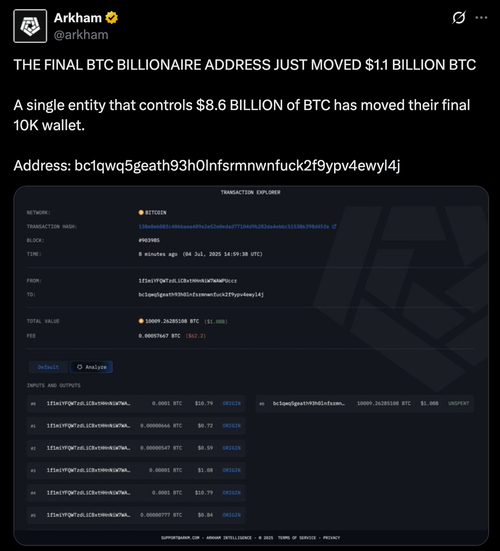

12/➮ That same day, Trump signed a sweeping crypto bill and 2011 BTC whale wallets suddenly moved

🕷 Too many symbolic moments in 24 hours

🕷 One in TradFi, one in crypto – both linked to data, identity, and control

🕷 And both quietly running through XRPL rails

13/➮ Brad Garlinghouse said: “The government owns your identity”

🕷 But Ripple is now building systems to reverse that – from DID support to encrypted metadata and on-chain verifiable credentials

🕷 This isn’t rebellion – it’s institutionalized sovereignty through infra

14/➮ BlackRock’s Aladdin manages $20T+ in assets – it’s the brain of global capital

🕷 Rumors say it’s being tested with blockchain-based settlement rails

🕷 XRPL is one of the few ISO-compliant chains that can plug in

🕷 All signs point to a silent trial already in motion

15/➮ So what are we really seeing?

🕷 Ripple provides programmable, regulatory-ready infrastructure

🕷 BlackRock brings volume, liquidity, and market access

🕷 Together, they tokenize real assets and enable digital ID – on rails that governments can tolerate

16/➮ This isn’t a partnership announcement. It’s deeper.

🕷 It’s the quiet convergence of old money and compliant crypto

🕷 And the pieces are already live – moving real value, with real regulators, and real intent

🕷 Most people won’t notice until it’s finished

125,63K

Johtavat

Rankkaus

Suosikit