Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

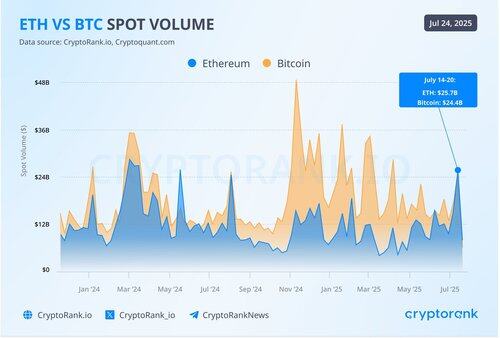

Ethereum weekly spot volume surpassed Bitcoin's

$ETH weekly spot volume hit $25.7B last week vs $BTC's $24.4B. It happened for the first time in over a year.

Is ETH’s performance a sign that altseason is near?

Covered in the thread 👇🧵

1/ $ETH volume grows as capital rotates to alts, after $BTC stalled post-ATH.

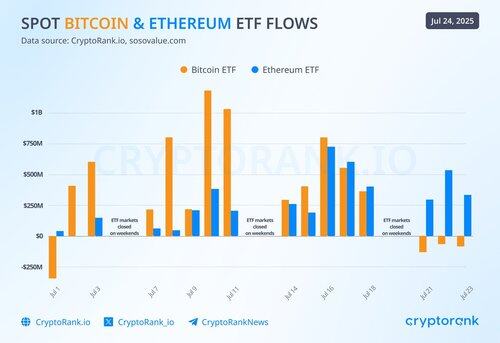

ETF inflows also contribute to wider ETH growth. The 14-day streak continued on July 23, with $332M added.

BTC ETF has seen net outflows for 3 days in a row, with $85M flowing out just yesterday.

2/ Ethereum’s growth is reflected in its open interest.

The indicator hit a $28B ATH on July 22 and is now sitting around $26B.

Also, $150M of $ETH positions were liquidated in the last 24h. Interestingly, $111M were long positions, shaken out by a temporary pullback.

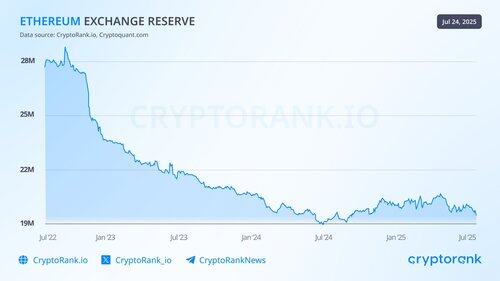

3/ $ETH exchange reserves are close to the all-time low.

Typically, it is a positive sign for a coin. It suggests investors prefer holding Ethereum rather than selling it.

Lower supply on exchanges may reduce selling pressure, potentially driving $ETH prices higher.

4/ So $BTC sees ETF outflows and is behind $ETH in spot volume.

However, the altseason index (ASI) dropped from 62 to 48 in the last few days. Despite BTC's relative weakness, alts aren't gaining ground.

Don't miss altseason. Track ASI on CryptoRank:

14,84K

Johtavat

Rankkaus

Suosikit