Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

$GIZA Tokenomics Report is out!

It explains why $GIZA was created, how it's designed to function, and whether the first two months of data confirm its logic.

The report is structured across three analytical pillars:

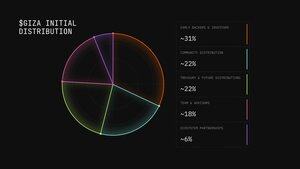

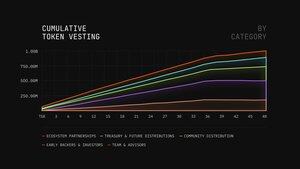

𝐃𝐢𝐬𝐭𝐫𝐢𝐛𝐮𝐭𝐢𝐨𝐧: How ownership migrates

𝐀𝐛𝐬𝐨𝐫𝐩𝐭𝐢𝐨𝐧: How the market metabolizes supply 𝐓𝐫𝐚𝐜𝐭𝐢𝐨𝐧: Whether usage sustains demand

This thread summarizes each with the key data.

𝐃𝐢𝐬𝐭𝐫𝐢𝐛𝐮𝐭𝐢𝐨𝐧

All unlocks are linear, across all categories.

Unlike vanilla vesting schedules with massive early cliffs, linear, months‑long slopes for every cohort dampen liquidity shocks, preventing speculators from front‑running real users.

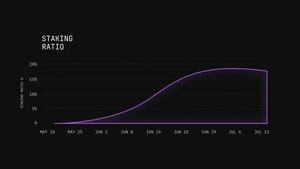

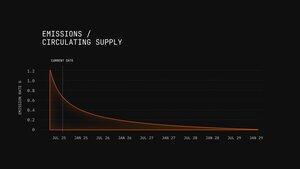

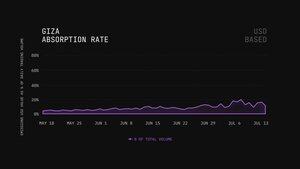

𝐀𝐛𝐬𝐨𝐫𝐩𝐭𝐢𝐨𝐧

The token economy is metabolizing emissions efficiently.

Supply growth dropped from 1.2% at launch to below 0.2% in 60 days.

Trading volume has consistently absorbed new supply with an Emission-to-Volume ratio under 10%.

Meanwhile, staking reached 20% of circulating supply, reducing liquid float and signaling market conviction.

Together, these trends point to a market structure that is absorbing supply without dislocation.

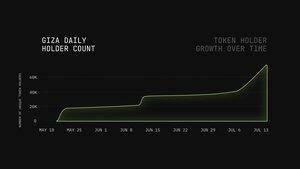

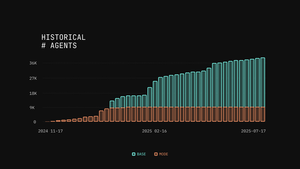

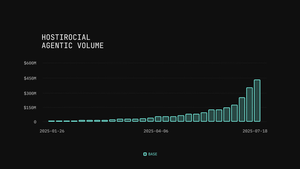

𝐓𝐫𝐚𝐜𝐭𝐢𝐨𝐧

~60,000 unique holders

36,000+ deployed agents

$500M+ in agentic volume

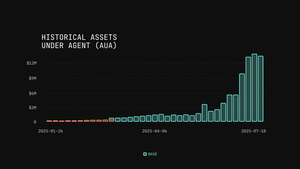

$11M+ in assets under agency

Growth across all metrics closely tracks product releases, confirming that utility is the main driver of token engagement.

The data supports the central thesis:

Emissions are paced and aligned with product growth

Supply is absorbed by real demand

Utility drives ongoing engagement

$GIZA functions as the coordination layer for an emerging agentic economy.

40,82K

Johtavat

Rankkaus

Suosikit