Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

MEV often means extraction, but "Good MEV" exists in blockchain as well.

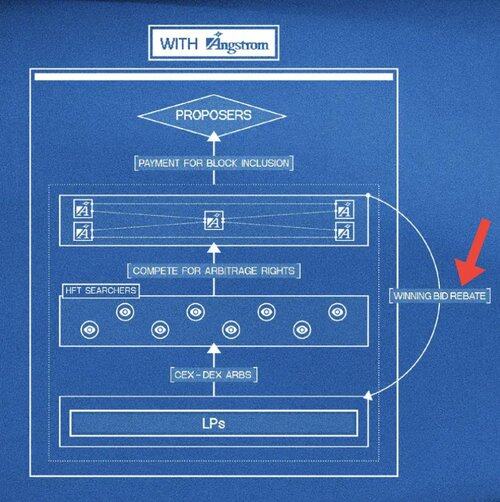

Here's a high level concept of @angstromxyz:

- 1. Using Uni V4 hooks, the pool is locked so only authorised validators can execute orders.

- 2. Any arbitrageurs can submit bids to the authorised validators and highest bidder wins.

- 3. The bid is distributed back to LP, the value that was previously captured by external searchers / builders.

- 4. Then, all the users trade order are gathered in a batch. Orders in the patch are executed in an uniform price discovered by a matching engine.

Therefore, there will be no point for frontrun because the price is uniform in the block anyway.

- 5. Pool is unlocked by v4 after (4) and open for general interaction.

----------------------------------------------------

Quick thought :

This looks like a good hook usecase and infrastructure for protocols that want to protect their LPs and users from MEV, which gives them better yields and swap rates.

( Lock by hook > Internal bidding and returns > Unlock by hook)

However, I think the authorized searchers / validators would need to be run by the project team, since there's little incentive for 3rd parties to do this voluntarily.

(If I have misunderstood anything please correct me)

3,36K

Johtavat

Rankkaus

Suosikit