Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Ethereum is no longer just a blockchain.

It’s a global financial engine, quietly matching or beating the world’s biggest companies.

Here’s how $ETH stacks up against Big Tech, Wall Street, and the internet itself.

( a thread )

@ethereum Everyone’s building on Ethereum.

From Nike to JPMorgan. Visa to Adidas.

It’s becoming the backend for money, identity, and ownership across the Fortune 500.

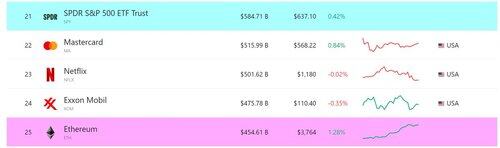

$ETH is now worth $450 billion+.

But zoom out, and it’s still tiny compared to the world’s biggest asset classes.

We are still early.

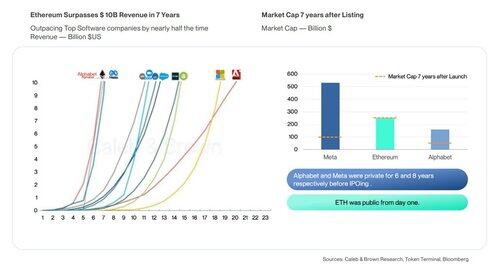

Ethereum reached $10 billion in cumulative revenue faster than Meta or Microsoft did.

It took Ethereum ~7.5 years to hit that mark, compared to just over 7.5 years for Meta and 19 years for Microsoft.

Unlike them, $ETH was public and permissionless from day one.

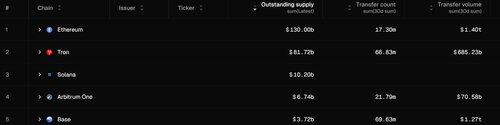

$ETH is already doing the jobs legacy institutions were built for:

- Moves money like Visa

- Coordinates finance like a bank

- Powers culture like a global auction house.

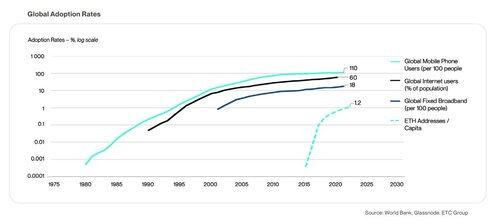

$ETH adoption is tracking the early growth of the internet and mobile phones.

The curve looks small now (but so did broadband in 2002).

If this pattern holds, the biggest gains are yet to come.

If you found value in this and would like to give back.

You can follow us @MIlkRoadDaily.

Or consider subscribing to our newsletter.

It's free ⤵️

@ethereum Get smarter about crypto with our daily 5-minute newsletter

We give you the lowdown on what matters in crypto and make you laugh in the process

Join 300,000+ daily readers:

35,72K

Johtavat

Rankkaus

Suosikit