Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

In partnership with @hyperbridge, Bunni is currently offering some of the highest APYs on-chain for @polkadot's DOT

Our DOT/ETH pools are live across Ethereum, @Arbitrum, @Base & @BNBChain. Not only is this a blue-chip pair with interesting tailwind exposure, but predefined $vDOT emissions per pool—no dilution, but capped.

This is not a drill 👇🧵

2️⃣ The macro tailwinds set‑up:

• DOT demand pops with new activity from Polkadot Hub and Coretime auctions

• ETH supply keeps shrinking as demand grows for ETFs + staking.

Pair them as an LP on Bunni, and you’re long both tailwinds while compounding swap fees, lending fees, and collecting migration incentives.

3️⃣ One click, three stacked revenue streams:

Add liquidity to the DOT/ETH pool on Bunni and earn.

💰 Earn swap fees via Bunni DEX

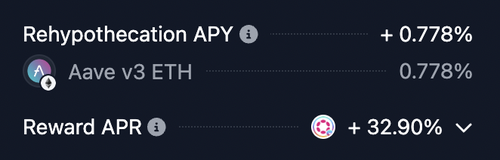

🏦 Earn lending fees via Bunni Rehypothecation

💸 Earn vDOT Migration rewards from @hyperbridge

4️⃣ Here’s why the yield holds up:

Bunni Rehypothecation - Idle assets earn in @eulerfinance and @aave vaults until they are needed. These vaults scale, and so do the lending fees. Returns vary with market conditions.

Capped vDOT incentives - Migration rewards have a cap on the amount of TVL that can be eligible to earn. Instead of seeing huge numbers that get diluted, we display what you will earn! Designed to reward early liquidity, but DYOR before depositing.

Bunni LDFs & Shapeshifting - Bunni tech will automatically work to keep your assets inside the pool parameters.

Bridge DOT using @hyperbridge → deposit → and monitor your position. Rehypo and swap fees boost returns, but yields vary.

DOT liquidity now lives on Bunni. 🐰

Disclaimer: This is not investment advice. Yields are variable and depend on market conditions, smart‑contract risk, and protocol governance. Do your own research.

10,61K

Johtavat

Rankkaus

Suosikit