Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

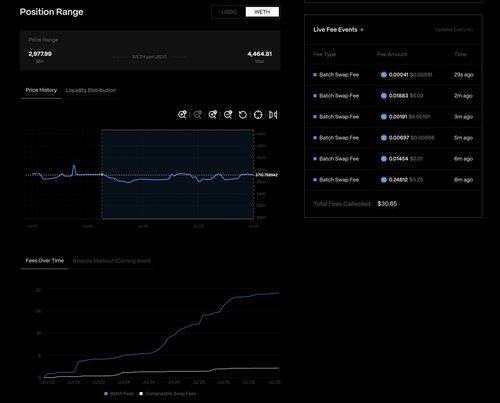

Timely to see this currently happening live in Angstrom! At current liquidity levels, the gas-imposed bid-ask spread is ~$1.75 for WETH/USDC – the top-of-block auction is consistently bidding any excess Binance deviation beyond this spread back to LPs.

In the short term, increasing the underlying liquidity will further tighten this spread and amortize the fixed gas cost over all active liquidity in the range of reference-price deviations, which will effectively bid all common value (that is currently being extracted from other pools) back to Angstrom LPs.

From here, increasing sandwich-resistant swaps going through the batch and solvers + routers sourcing liquidity from Angstrom in the pool-unlock state for composable swaps will result in positive markouts and incentivize further liquidity migration to Angstrom.

This is a potent and inevitable positive feedback loop.

26.7. klo 22.16

🚨 Interesting update to our model of LVR with fees! Our updated paper with @ciamac @Tim_Roughgarden now also captures gas fees. Most importantly, we prove that lower gas fees **help LPs** by reducing LP losses. 1/2

4,71K

Johtavat

Rankkaus

Suosikit