Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

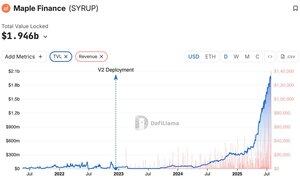

There’s quite surge in $SYRUP price atm. Here’s why👇

> TVL is $1.94B (massive growth in 2025)

> Q2 ARR went $5M (Q1) → $15M

> Offering fixed rates of ~9.1% for lenders

> Mcap is ~6x from April lows sitting at $655M

Users deposit USDT/USDC → get syrupUSDC → earn from institutional borrowing pools

Recent MIP-018 proposal wants to increase buybacks from 20% to 25% of revenue. That's $3.75M annually.

Decide for yourself. Higherrr

25.7. klo 00.00

$2.6B AUM. $15M ARR. 200% revenue growth Q/Q.

In Q2 Maple became the largest onchain asset manager, surpassing BlackRock while delivering institutional-grade yields across DeFi.

The institutional DeFi renaissance is here, and it's happening on Maple.

4,74K

Johtavat

Rankkaus

Suosikit