Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

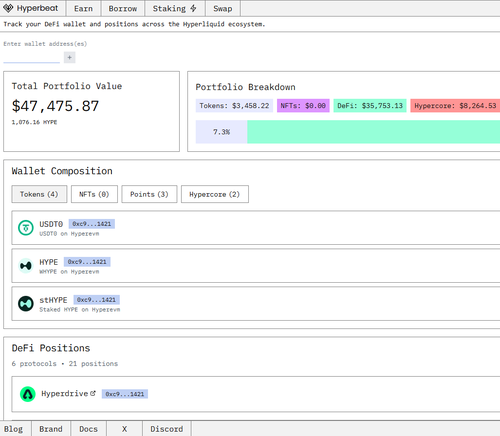

I do not care what people say - but hyperEVM is one of the most competitive places to try and earn points on protocols I've ever seen.

Like, $25k in there for over a month and not even remotely making a dent.

I started farming hyperEVM late as I had funds locked elsewhere - so I know I'm not early by any stretch, but if these hyperEVM protocols run a linear points program I'm pretty sure most of us are getting absolute peanuts.

Regardless, if you have no time to research but want to start, here's a basic guide for simply parking assets and earn yield/points 👇

1) Bridge - if you want it easy, you can bridge from @JumperExchange - but expect bad slippage.

Otherwise you can use @hyperunit and withdraw assets to EVM via Hyperliquid Core.

Both bridges are tokenless 🪂

2) Deposit USDT0 into single sided pools with no impermanent loss:

Hyperbeat here:

Hyperdrive here:

Sentiment here:

Liminal here:

Felix here:

HypurrFi here:

Hyperlend here:

Or pools with IL:

This is basic, but crucially they're all protocols you can very easily just park stables and earn points.

Most these pools have high APY right now as well which doesn't hurt.

After you've deposited, there's always room to borrow assets and deposit them into other protocols and loop everything to make your TVL go as far as possible.

If you loop, please be careful with your LTV and liquidation thresholds.

@0xasrequired @JumperExchange @hyperunit Also a lot of your quotes look good but when you go to confirm it completely changes

11,04K

Johtavat

Rankkaus

Suosikit