Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Not long ago, choosing ETH as a strategic reserve might’ve sounded speculative.

But today, it’s increasingly a rational move, and I think we’re only at the beginning of this shift.

What strikes me most is how ETH has quietly transformed from a misunderstood smart contract asset into programmable reserve collateral for the digital economy.

The total Strategic ETH Reserve is now 2.32M ETH (~$9B). It has increased almost 2x since July 6th.

The top 3 ETH strategic companies are:

🥇 Bitmine: $2.2B ETH

🥈 Sharplink: $1.4B ETH

🥉 Ether Machine: $659M ETH

Moreover, buying pressure is not just coming from ETH strategic companies; it’s also from ETF holdings.

The cumulative trading volume on the ETF has surpassed $118B, with a 16-day streak of positive ETH amounts since July 3rd.

📌 So, why are they so bullish on ETH?

Because Ethereum isn’t just a settlement layer; it’s the financial operating system of modern markets.

– ETH provides programmable yield through staking, now made institutionally viable via SEC-approved terms.

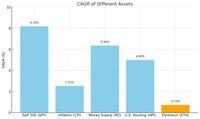

– Its adaptive monetary policy keeps long-term inflation below 1%, stronger than gold.

– It anchors over $130B in stablecoins, secures over $200B in assets, and supports major institutional deployments from #BlackRock, #JPMorgan, and Robinhood.

– Most critically, ETH is used to power, secure, and settle every function these companies bring on-chain, from #RWAs to #DeFi rails.

The logic is simple: if your infrastructure depends on Ethereum, owning ETH becomes a matter of alignment, not speculation.

It’s exactly the kind of buying pressure that quietly builds toward ATH.

10,99K

Johtavat

Rankkaus

Suosikit