Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Yesterday, after the @TreehouseFi token was launched, those who staked / Alpha must be feeling a bit lost, unfortunately only getting the low guarantee. Recently, Binance's selection of tokens has gradually improved, favoring "financial products that have been validated by traditional finance and have real applications." I continued to look into their token $TREE.

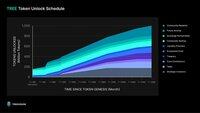

🌊 Circulation

Currently, the initial circulation is less than 20%. Apart from community rewards and exchange market-making tokens, investors and the team will need to wait six months to unlock their tokens. However, as far as I remember, Binance generally requires a one-year lock-up period for team tokens, so I'm not sure if this has been updated.

🧱 Staking

The staking for the $TREE token has also started, and you can check the official website. Currently, it is in the pre-deposit Vault, and the pre-deposit needs to be entrusted to the previously mentioned "expert group" role to help them function in the DOR system, thereby earning rewards. Here are some mechanisms:

- The amount of rewards is related to the expert role you choose; the stronger the ability, the higher the reward.

- The official estimated APR range is 50% to 75%, depending on the accuracy of the expert group (see the image below).

- The staking window is only open for 30 days, and once staked, you cannot withdraw for 9 months, so be aware of this.

- A minimum of 10 tokens is required, with a maximum of 1.5M.

🙋 Participation Strategy

If you are optimistic about TreeHouse's sector in the long term and plan to hold without selling in the short term, you might consider it.

If you are taking a neutral strategy, let's analyze it together:

- The biggest benefit here is the guaranteed 50% APR, so if you stake, you can calculate the number of tokens you will receive after 9 months. If you are satisfied with the current price, you can lock in profits early.

- The risk is the 9-month lock-up period and the uncertainty brought by price fluctuations. Generally, the coping strategies are either hedging or borrowing tokens.

- For hedging, since last year, most hedging strategies have faced the risk of being squeezed by fees, especially after the market turned bearish.

- For borrowing tokens, you can pay attention to Binance's borrowing options (currently none) or other exchanges' fixed rates. Binance is advantageous due to its favorable rates and smooth rate curve, while other exchanges' fixed rates are controllable. However, in 9 months, anything can happen, so make sure to have a strategy and keep your mind open.

29.7.2025

🌳 This is Gaia: $TREE is now live!

It’s time to claim, stake, and shape the future of fixed income in DeFi 🌱

TREE powers utility, governance & alignment across Treehouse—the Decentralized Fixed Income Layer.

Welcome to Gaia. 🧵👇

[updated live]

10,62K

Johtavat

Rankkaus

Suosikit