Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

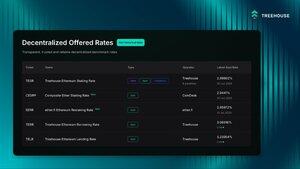

🌳 New DOR Spot Rate: CESR by @CoinDesk Indices

Built with @coinfund_io, CESR is an institutional-grade benchmark for ETH staking.

Now transparent, on-chain & ready for builders. ✨

DOR is becoming the reference layer for yield benchmarks in DeFi. 🧵👇

@CoinDeskMarkets 1️⃣ What is CESR?

CESR is a daily benchmark that tracks the average annualized yield earned by Ethereum validators from staking. 📈

It captures:

• Consensus rewards

• Priority fees (aka tips)

• Deposits, withdrawals & slashing

2️⃣ Why CESR matters. 📈

ETH staking yields today are fragmented.

They're all over the place across LSTs, CEXes, and staking platforms.

Benchmarks like CESR cut through the noise by giving everyone, from users to protocols, a single, standardized ETH staking benchmark.

27.3.2025

🌳 Introducing Treehouse Rates Dashboard

We’ve been saying: DeFi rates are fragmented.

Now, we’re proving it.

Our live dashboard shows the fragmented ETH lending, borrowing & staking rates across DeFi—making a case for why DeFi needs benchmarks. 🧵👇

3️⃣ What can benchmarks like CESR do? 📊

Protocols can use DOR rates like CESR to:

• Anchor staking vaults to a trusted rate

• Price ETH-based loans, swaps & fixed-income products

• Track validator performance over time

• Compare yields across platforms with confidence

4️⃣ CESR joins the DOR ecosystem.

CESR is the latest addition to DOR benchmark offerings in shaping DeFi’s yield standard.

With more rates and operators on the way, DOR is becoming the backbone for on-chain fixed income. 🌳

Check out DOR 👇

🌳 Learn more about the Treehouse Protocol:

Website:

dApp:

Discord:

Docs:

Guide:

Blogs:

Book:

90,1K

Johtavat

Rankkaus

Suosikit