Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

🧵

1/7

Our take on SEC's Project Crypto and ETH impact:

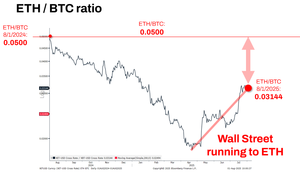

$ETH ethereum outperforming the crypto since early April. Below shows ETH/BTC ratio and we can see the sustained rise

...fueling this is Wall Street running towards ETH as stablecoins created the "chatGPT" moment

ticker: $BMNR

2/7

Yesterday, SEC and White House unveiled 'Project Crypto' to move financial markets on-chain

@CNBC

ticker: $BMNR

3/7

The goal is to forge US leadership in the 'golden age of finance'

- moving financial markets onto the blockchain

- the largest 'smart contract' blockchain is ETH

ticker: $BMNR

5/7

In the near-term, this argues the ETH/BTC ratio should recover to at least where it was 1-year ago:

- the ETH story is stronger today than August 1, 2024

- Bitcoin is $114k

- at 0.0500 ETH / BTC

- ETH implied is $5,707

ETH is currently $3,600

@fundstrat digital asset team sees ETH fair value around $10,000-$20,000 potentially in the next 12 months

ticker: $BMNR

6/7

Longer term, keep in mind, as Wall Street tokenizes real-world assets, Wall Street will stake ETH. Our take is here

👇

ticker: $BMNR

1.8. klo 05.24

The comment by materkel.eth @materkel is key

👇

As Wall Street moves to financialize the world onto the blockchain, Wall Street will stake ETH to be involved in the enhancement of ethereum. That is the difference between centralized finance and defi.

$ETH

7/7

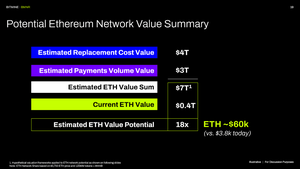

What does that mean for ETH valuations longer term? When Wall Street financializes onto the blockchain, and they own the protocol layer.

This implies $60,000 ETH or more.

This is for illustrative purposes only and not a forecast

ticker: $BMNR

240,04K

Johtavat

Rankkaus

Suosikit