Argomenti di tendenza

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

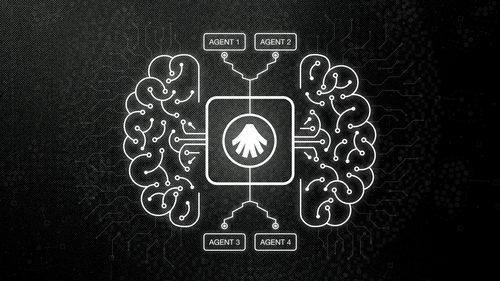

DeFAI agents that don’t rely on static code but evolve based on performance signals and context.

Allora is the intelligence layer that enables this:

• Yield agents rebalance based on probabilistic forecasts, not fixed heuristics.

• Trading agents integrate crowd-sourced inference to update risk models in real-time.

• Allocation agents dynamically shift capital across vaults, AMMs, and lending markets.

• DCA agents pace accumulation according to momentum, volatility, and trend reversals.

• Market agents act on the collective conviction of the Allora network—on-chain alpha becomes executable logic.

Each agent improves as the network learns, turning inference into strategy and context into the ultimate edge.

37,51K

Principali

Ranking

Preferiti