Trendande ämnen

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

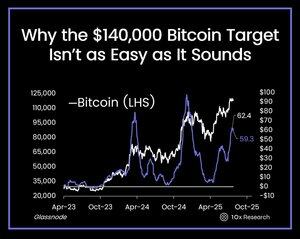

🔥10x forskning: Bitcoin står inför en kritisk böjningspunkt, och målet på 140 000 dollar kanske inte är lätt att uppnå

10 x Research @10x_Research släppt en analys på X-plattformen som visar att trots Bitcoins starka rörelse i år, försvagas marknadsmomentumet och går in i den svagaste säsongscykeln i historien. Dess säsongsmodell har exakt förutspått marknaden fem månader i rad, och varningssignaler dyker för närvarande upp. Faktorer som avtagande kapitalinflöden, svagare on-chain-data och brist på nya katalysatorer kan leda till en ny fas på marknaden eller tvinga fram en alltför optimistisk justering av prisförväntningarna.

30 juli 2025

Why the $140,000 Bitcoin Target Isn’t as Easy as It Sounds

Actionable Market Insights

Why this report matters

Bitcoin has delivered an impressive rally this year, but momentum may be fading just as the calendar turns to its weakest stretch.

Behind the headlines of ETF inflows and bullish price targets lies a more nuanced reality: capital appears to be peaking, not accelerating.

For five straight months, our seasonal model has accurately tracked Bitcoin’s trajectory—and it’s now flashing a very different signal.

A subtle shift in on-chain data, weakening market structure, and a void of fresh catalysts could all combine into a new phase.

The market doesn’t yet realize it, but time may be running out. What happens next could force even the most optimistic forecasts to reset.

Main argument

Over the past five months, our seasonal Bitcoin model has closely aligned with actual market performance.

Historically, Bitcoin tends to underperform in January following a strong fourth quarter—but in 2025, it rallied instead, driven by optimism around a crypto-friendly Trump presidency.

February, which typically sees a rebound, underperformed this year. However, since March, the model has reliably tracked Bitcoin’s trajectory.

For July, we projected a +9.1% gain (here), and Bitcoin is currently up +9.8%, underscoring the model’s effectiveness in capturing market seasonality.

Bitcoin is approaching a critical inflection point—not just driven by seasonal trends or market structure, but by a key on-chain indicator that may offer early insight into its next major move, as we detail below.

Read the full report: link in bio/comments

997

Topp

Rankning

Favoriter