Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

TN | Pendle

Co-founder, cooking @pendle_fi

TN | Pendle kirjasi uudelleen

Treehouse x Silo x Apostro

Our ETH Core vault on Silo now supports assets from @TreehouseFi's universe: tETH and PT-tETH by @pendle_fi.

Borrowers can enjoy:

1░ $10.8 mil in ETH liquidity and up to 56% yield on PT-loops.

2░ 10 nuts per tETH.

3░ Quirky posts by @SiloIntern.

12,02K

TN | Pendle kirjasi uudelleen

The photo taken casually while eating back then by @tn_pendle has been completely ruined by @PendleIntern using AI 🤣.

In short, the boss and the team are really great people, extremely talented and gentle, fun genius kids club.

I firmly believe that Pendle will go very far.

Grandma has always placed great importance on her career and really needs to have faith in her work, so choosing a job is also a bet on investing in her future growth.

Our ambition is to make all yields tradable, including off-chain yields.

While Pendle unlocks the yield trading of every asset, it not only empowers the value of that asset but also provides the market and users with more controllable and observable returns.

Therefore, in today's increasingly mature DeFi landscape, any institution or traditional financial player wanting to participate in DeFi will definitely choose Pendle.

Under this prerequisite, how to optimize our products (Pendle V2 & Boros), how to unlock more assets, and how to better accompany deep capital entry are the key points of Pendle's roadmap this year.

The second half of @pendle_fi will have a lot of bullish developments, from launching HyperEVM, to the new Boros product, to cross-chain and KYC institution PT, Grandma has quietly increased her holdings 🙈. (NFA)

Joining Pendle is truly the best decision Grandma has made~~~

Job’s not done,

moaaaaar actions,

Pendle.

8,98K

TN | Pendle kirjasi uudelleen

On Lending Market Forces (DeFi 2.0 Credit Frontier):

Credit remains the most foundational primitive of productive composability in DeFi.

The entire idea of 'Money Legos' was born from the ability to reuse, collateralise & iterate on the same asset across protocols.

This is what fuelled DeFi 1.0’s explosive growth.

With DeFi 2.0, we’ve moved from simply replicating core primitives to building enhanced, modular layers on top eg. @pendle_fi with yield tokenisation or LSPs offering restaking opportunities.

We’re now in a mature DeFi phase where:

🔸The primary layer (DEXs, lending etc.) is cemented

🔸DeFi 2.0 protocols are highly composable but often under-integrated, esp. for more complex or niche assets

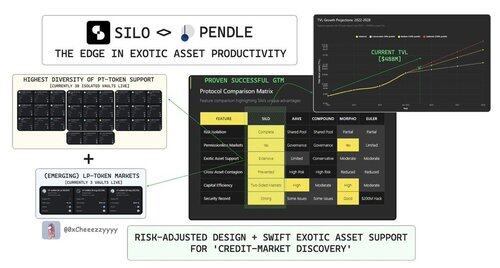

This is where @SiloFinance plays a crucial role with its core strengths in:

1. Swift support for exotic DeFi assets

2. Risk-isolated vaults that contain protocol-specific risk, preventing contagion

This unique architecture makes Silo a composability enabler to unlock credit markets for tailored or yield-bearing assets that don’t easily fit in monolithic lending markets.

The results are alr demonstrating: Since launching V2 <5 months ago, Silo has grown to ~$0.5B TVL.

Silo has arguably become the go-to lending layer for Pendle assets discovery with 30+ PT token & 3 LP vaults already live.

tbh there's still lots of potential for credit expansion on Pendle give:

🔹 PT tokens → time-appreciating assets = low-risk yield-bearing collateral)

🔹 LP tokens → emerging yield primitives with high future potential)

imo Silo will be the avenue for formalising standards in DeFi-native credit market moving forward as innovation exponentiates.

As integrations grow + more DeFi 2.0 assets seek lending utility, expect other lending protocols to follow this playbook.

Super Silo

11,08K

TN | Pendle kirjasi uudelleen

Pendle : the new institutional playbook in DeFi

Thriving through different market cycles into its 4th year, @pendle_fi has been quietly evolving from a savvy yield-layer platform into a multi-pronged institutional powerhouse, here’s why you should be ultra bullish.

For any DeFi protocol, graduating into institutional-grade infrastructure signals a deeper, more mature phase of growth. With a unique fixed yield primitive and a rapidly growing ecosystem, Pendle is poised to become the foundation for institutional access to DeFi yield.

⛩️Pendle V2: Better, Faster, Stronger

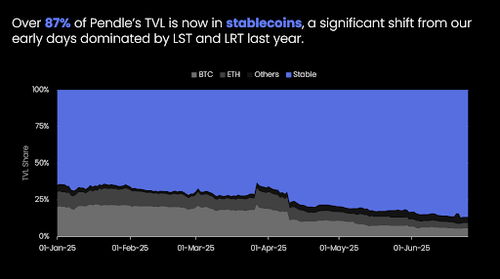

As we step into a new growth phase, the revamped V2 with sleeker mechanisms is opening up for all the most popular protocols in DeFi, especially yield bearing stablecoins as the strongest asset, offering more sustainable and competitive yields. With over 100 active pools, Pendle is now the indispensable yield market for all.

⛩️Pendle PT dominance

Pendle PTs are reshaping the role of collateral in DeFi. Today, over $2.67B worth of PTs are actively used as collateral—and that number’s growing fast.

As of today, @aave alone holds over $2.1B in PTs, a staggering endorsement of the model. The protocol has raised supply caps multiple times to keep up with demand.

These assets now represent a core yield-bearing layer for lending protocols, enabling capital efficiency while introducing fixed income concepts familiar to TradFi.

With cross-chain PTs on the horizon, PT is set to unlock a new wave of adoption across broader lending markets.

⛩️Boros: the ultimate yield trading monster

Unlocking funding rates as a robust new yield source, we are taking bold steps to unleash this new beast as its power will be unparalleled. The very first fully on-chain order book of @boros_fi with unprecedented capital efficiency will offer a wide variety of trading strategies.

⛩️The Ethena Squad :Institutional Synergy in Motion

Pendle’s deep integration with @ethena_labs is more than a partnership—it’s a strategic alliance.

With over 60% of Ethena’s TVL empowered by Pendle, this partnership is growing stronger by day.

As a launch partner, Pendle’s unique yield-trading mechanisms will continue to play a crucial role in the growth of @convergeonchain , designed for institutional plays. This Ethereum-compatible chain blends permissionless DeFi with KYC-compliant tokenized RWAs, such as BlackRock’s BUIDL. With strong liquidity flowing into @etherealdex , @Terminal_fi is also gaining traction, attracting over $60 million in liquidity in the blink of an eye.

In a nutshell, Pendle is doing what ETFs, swap desks, and structured product desks do in TradFi—but on-chain, composable, and 24/7.

Pendle will keep proactively building the infrastructure to lead the way, as Institutional adoption becomes the next step for DeFi.

Job's not done, more actions.

Pendle

11,27K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin