Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Cheeezzyyyy

part-time yapper; janitor @mementoresearch; prev @pendle_fi SWE

Cheeezzyyyy kirjasi uudelleen

InfiniFi Labs is changing the game in decentralized finance by offering innovative ways to boost yields without using leverage segmenting stable assets for better returns while ensuring safety and efficiency in capital use.

This protocol is seeing a rapid rise in its metrics thanks to recent launches and integrations.

Let’s dive into the details of this groundbreaking on-chain banking solution🧵

383

Cheeezzyyyy kirjasi uudelleen

This whole follower count obsession is backwards thinking.

I've watched KOLs with 50-80K followers get ignored by their own community while accounts with 3K followers move markets with a single tweet. The difference isn't numbers - it's trust.

You can spot the bought followers easily. High follower count + high engagement, generic comments that don't match the content. These accounts may get brand deals based on vanity metrics but ZERO real influence.

The real test isn't how many people follow you. It's whether anyone actually reads when you write.

I know creators who've been here six months retweeting everything, farming impressions with T4 project shills. Sure, they hit 30-40K views per tweet. But ask them for an original thought on market structure or protocol design & you get silence.

Meanwhile, the builders & researchers with smaller followings are the ones projects actually consult for feedback. They're in the group chats where real decisions get made.

Elon's recent bot cleanup was brutal but necessary. Watching follower counts drop 30-50% overnight (I myself saw some accounts I had doubt on) exposed how fake this whole ecosystem had become.

Quality projects & quality agencies can smell artificial engagement from miles away. They'd rather work with someone who has 3000 real followers than 50K fake ones. Because when you're spending marketing budget, you want actual humans seeing your content.

The irony is that chasing follower count actually hurts your credibility with the people who matter most. Real recognizes real & fake followers don't fool anyone worth impressing.

Build something worth following instead of following the crowd.

Here are my favorite 30 creators who actually bring value to this space (Plus they don’t fight for mindshare)

Sub 5k: @bullish_bunt @sakshimiishra @CipherResearchx

5-10k: @0xCheeezzyyyy @kenodnb @RubiksWeb3hub @Jonasoeth

10-25k: @Moomsxxx @ahboyash @francescoweb3

25-50k: @eli5_defi @0xTindorr @arndxt_xo @CryptoKoryo @zerokn0wledge_ @Mars_DeFi @poopmandefi

50-100k: @hmalviya9 @splinter0n @stacy_muur @Defi_Warhol @TheDeFiPlug @0xAndrewMoh @the_smart_ape @defi_mago

100k+: @Axel_bitblaze69 @DefiIgnas @TheDeFinvestor @thedefiedge @DeFiMinty

3,69K

Cheeezzyyyy kirjasi uudelleen

If I had to pick just one narrative to focus on, it’d be institutional-grade DeFi.

That’s why I’m sharing @Terminal_fi, the BlackRock-backed marketplace for institutional asset trading.

Terminal has grown to $137M in TVL over days, with ~67% of inflows from @pendle_fi. 🧵

9,9K

Cheeezzyyyy kirjasi uudelleen

The Mantle ecosystem has been buzzing for months on end, and yields are juicier than ever.

If you’ve been keeping up with my @Mantle_Official yield series, you’ve probably been expecting a third part of the guide. So here’s me bringing you more low risk yields to explore.

13,2K

Cheeezzyyyy kirjasi uudelleen

$USDe just pulled in $2B in a week. What was the reason?

The simple explanation is yield. @ethena_labs’ offering 10% on sUSDe. Money flows to the highest risk-adjusted return, & right now that's clearly Ethena

> USDC, USDT make money when Treasury rates are high

> Ethena makes money when crypto markets are volatile & perpetual funding rates spike

> It has paid out the most amount of yield ($39M sUSDe) in the last 90D

> $30.85M fees generated over the past 30D

> $USDtb becoming GENIUS Act compliant is institutional onboarding infra.

> They recently called their $260M goes toward $ENA buybacks over six weeks (8% of CS getting absorbed)

> Fee switch is a major catalyst

Look, 10% yields don't last forever in crypto. Someone always comes along offering 12%, then 15%. But @ethena_labs’ revenue model is different enough that it might have staying power.

The institutional money flowing through @convergeonchain & the ecosystem plays around @Terminal_fi, @etherealdex, @strata_money shows real capital is taking positions.

10,84K

Cheeezzyyyy kirjasi uudelleen

Yo if you're just sitting on the sidelines while the market’s doing its thing - don’t let those stables collect dust. There’s some good yield floating around if you know where to look 👀

Check this:

@pendle_fi x @aegis_im is lowkey printing right now with $sYUSD.

───────

What’s happening?

Right now you can lock in 15.07% APY on sYUSD PTs on Pendle - even though the base yield is only like 4-6%. Why the premium?

Because there’s a fixed weekly airdrop farming meta going on:

• 0.2% of total supply going to YUSD/sYUSD holders

• Extra 0.1% for using it in DeFi (Pendle gets the biggest boost)

Basically, the earlier you farm, the more you get. No dilution from late farmers.

───────

Current farming stats for Pendle LP:

🔹 12.62% APR (just LP)

🔹 ~47% APR (w/ points at $50M FDV)

🔹 ~81% APR (at $100M FDV)

🔹 ~150% APR (if it pops off to $200M FDV)

You can stack even harder using an exclusive link that boosts your points by 10% 👇

12,53K

Cheeezzyyyy kirjasi uudelleen

Constant market adaptation is the cornerstone of a project's PMF strategy in every phase.

With the rising RWA wave and robust TradFi capital flowing into DeFi, Pendle is strategically transforming into a pivotal bridge through @ethena_labs and @convergeonchain.

So how can @pendle_fi do that? 👇

7,25K

Cheeezzyyyy kirjasi uudelleen

The number one L2 by TVL is @arbitrum at $17B. It has deep app breadth, live fraud proofs, and a maturing governance and treasury.

@Mantle_Official is the fourth L2 by TVL, but also one of the fastest-rising Layer 2s. It is built on OP Stack and runs with EigenDA as an alternative data-availability layer. Mantle controls the largest DAO treasury in crypto at $2.7B, which enabled a more institutionally focused game.

Both chains are pushing DeFi forward from different angles:

• Arbitrum by sheer scale, app density, and technical polish around fraud proofs and custom VMs.

• Mantle by modular DA experimentation, large on-chain capital programs, and a “liquidity chain” narrative.

Read more as I explain below 👇

---

☑️ How Are They Innovating In Practice?

Arbitrum is shipping at the proving layer. BoLD wants to make validation permissionless without abandoning optimistic rollups, and Stylus future-proofs the VM by letting devs write high-performance contracts in Rust, C, and C++. Combine that with Orbit and you get a spectrum from a shared L2 to tailor-made L3s, which is exactly what institutions, games, and high-frequency DeFi want. Its economic novelty is Timeboost. That is, selling priority through auctions turns MEV into a native protocol revenue stream instead of a pure externality.

Mantle is shipping at the DA and treasury layers. It is the first major L2 to fully integrate EigenDA. By this, DA costs turned into a tunable parameter, allowing them to underwrite more complex, data-heavy applications without spiking L1 calldata fees. On the capital side, the DAO is literally an onchain sovereign wealth fund:

• @MantleX_AI’s AI agents are for treasury management and institutional products.

• Mantle Index Four (MI4) is a pipeline to deploy billions with programmatic, transparent mandates. This enabled them to target narratives across AI, DePIN, and RWA verticals that need both capital and low data costs.

---

☑️ Development Standards and Ergonomics

If you are a Solidity team, deploying to either is trivial. Arbitrum’s Nitro is EVM-equivalent and tooling complete. Stylus widens the aperture for teams with Rust expertise, something that matters when you need heavy compute and want to avoid Solidity gas cliffs.

Mantle’s choice to anchor on OP Stack means you get the entire Optimism tooling, auditing corpus, and dev mindshare out of the box. That decision trades originality at the VM layer for speed and familiarity, which is smart if your differentiator is economics and DA, not VM features.

---

☑️ Institutional Evolution

Arbitrum’s DAO is certainly for real treasury management. They have:

• ATMC (Arbitrum Treasury Management Committee)

• Consolidation of idle USDC to reduce opportunity cost.

• Structured buyback proposals via bond issuance.

• Constant stream of constitutional and ArbOS upgrades passed onchain.

• Tokenized treasury deployment via STEP and SP programs

• Hosting tokenized stocks and ETFs through partners like Robinhood

Mantle’s institutional pitch is more capital-first. A $2.7B treasury and explicit index products are familiar objects for traditional allocators. The message is simple: come to Mantle, we can co-fund, co-structure, and programmatically manage risk onchain, and your DA cost profile will look like Web2 infra. That is very different from most L2s, and it is resonating.

---

☑️ Critical Aspects To Watch

1. Decentralization of Sequencers: Both are still running with centralized sequencers. Arbitrum has publicly articulated paths, while Mantle is earlier, and OP Stack chains share similar criticisms. Until we see multi-party, MEV-aware sequencers with real fault tolerance, both carry liveness and censorship risk.

2. Fraud-proof Reality Versus Roadmap: Arbitrum’s current system works today, but BoLD still needs to land fully and be adopted across Orbit. Mantle inherits OP Stack’s timelines, so its “trust minimisation” depends on Optimism’s own progress.

3. Treasury Execution Risk: Mantle’s edge is its treasury. Mispricing risk, governance capture, or poor yield discipline could erase that advantage fast. Arbitrum’s treasury is smaller in absolute dollars but more diversified in processes and committees. Bureaucracy can slow decisive moves in fast markets.

4. DA Trade-offs: EigenDA is cheaper, but it adds a new trust and liveness assumption set tied to EigenLayer and restaked operators. If that restaking market wobbles, Mantle inherits correlated risk that a pure Ethereum DA rollup does not. Conversely, Arbitrum pays materially higher L1 DA costs, which can compress margins in high load scenarios despite EIP-4844.

5. App Concentration and MEV: Arbitrum’s app layer prints fees for apps relative to what the chain earns, which is great for builders but raises a question: will protocol-level value capture lag too much, or does Timeboost close that gap? Mantle’s DeFi stack is still forming its “flagship cash cows”; until then, incentives shoulder the burden.

---

☑️How They Link and Make DeFi Better Together

Shared EVM equivalence and bridge standards mean liquidity, tooling, auditors, and even governance experiments hop seamlessly between them.

A protocol can spin up on Mantle to exploit EigenDA’s cheap data and Mantle grants, then launch an Arbitrum deployment to tap the deepest DeFi liquidity and perps flow. Cross-L2 liquidity routing and intent-based orderflow is becoming the norm.

The more Mantle subsidises new structured products or RWA rails, the more Arbitrum benefits as the venue where those assets get repriced and leveraged.

Conversely, as Arbitrum hardens fraud proofs and decentralizes sequencing, Mantle inherits best practices through the OP Stack and the general rollup research commons. This is positive-sum.

---

☑️ Wrap Up

@arbitrum is the scale, security-first rollup with the deepest DeFi stack, credible proof work, and a maturing governance economy.

@Mantle_Official is the modular, capital-rich upstart that is intentionally optimizing for lower DA costs and institutional-grade capital deployment.

The outcome is not zero-sum. If you are building leveraged DeFi, perps, or anything latency sensitive and liquidity hungry today, Arbitrum is still the most immediately defensible home. If you are building capital-intensive, data-heavy, or incentive-hungry products, Mantle’s treasury and EigenDA stack give you a cost-of-goods and funding edge.

Both are converging on the same endgame:

→ Credibly Neutral

→ Cheap blockspace with sustainable economics.

They are taking two different but complementary roads to get there.

Thank you for reading!

3,21K

Cheeezzyyyy kirjasi uudelleen

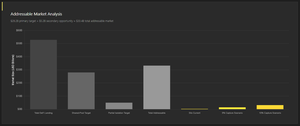

When I say ‘gSilo’ my brain pulls up these stats like muscle memory now

@SiloFinance is sitting at $520M TVL with a $33.4B addressable market in front of them.

🔷 $53B tvl DeFi lending & Addressable Market:

🔹Total DeFi Lending: $53B TVL

🔹Shared-Pool Protocols: $28.2B (Silo's 1st target)

🔹Partial Isolation Protocols: $5.2B (2nd target)

🔷 $Silo Current Position:

🔹$520M TVL (0.98% market share)

🔹120K+ users with 55.24% utilization

🔹Insane V2 growth in 6 months days

🔹Multi-chain presence across 5 networks

$28.2B is currently locked in shared-pool protocols that are structurally vulnerable to exactly the systemic risks Silo eliminates

➠

🔷The asymmetric setup

The market structure shows Silo as a tiny slice, but they're the only protocol that's actually solved the fundamental architecture problem.

The gap you see is a Recognition gap, not an execution gap

➠

🔷Cathmatics that checks:

If $Silo captures even a slice of the shared-pool market:

🔹2% = $668M

🔹5% = $1.67B (3.2x)

🔹10% = $3.34B (6.4x)

🔹15% = $5.01B (9.6x)

The upside is real, the architecture is different and the market is massive

➠

say gSilo back for the culture!! 🫡

6,8K

Cheeezzyyyy kirjasi uudelleen

So @BeamableNetwork caught my attention for a simple reason. They're solving a real problem in gaming.

Game developers waste 30-50% of their time managing servers. Backend costs hit 6 figures fast. When games scale, everything breaks.

Let me explain what they're building🧵

2,36K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin