Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Silo Labs

Silo Labs kirjasi uudelleen

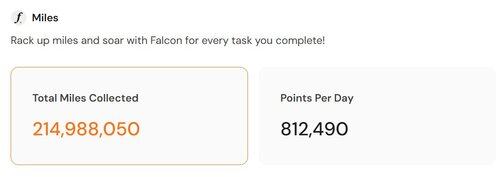

Your boy is now a HIGHLY profitable @FalconStable Miles Farmoooor.

His strategies:

1⃣ YT-sUSDf (Pendle) → grid-trading IY; exited accidentally w/ IY pump on points annoucnement

2⃣ LP-sUSDf (Pendle) → moved to 3⃣

3⃣ vfUSDC (Silo) → only position now

810k points/day not bad

4,05K

Silo Labs kirjasi uudelleen

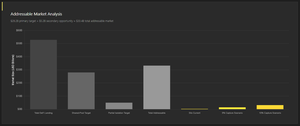

When I say ‘gSilo’ my brain pulls up these stats like muscle memory now

@SiloFinance is sitting at $520M TVL with a $33.4B addressable market in front of them.

🔷 $53B tvl DeFi lending & Addressable Market:

🔹Total DeFi Lending: $53B TVL

🔹Shared-Pool Protocols: $28.2B (Silo's 1st target)

🔹Partial Isolation Protocols: $5.2B (2nd target)

🔷 $Silo Current Position:

🔹$520M TVL (0.98% market share)

🔹120K+ users with 55.24% utilization

🔹Insane V2 growth in 6 months days

🔹Multi-chain presence across 5 networks

$28.2B is currently locked in shared-pool protocols that are structurally vulnerable to exactly the systemic risks Silo eliminates

➠

🔷The asymmetric setup

The market structure shows Silo as a tiny slice, but they're the only protocol that's actually solved the fundamental architecture problem.

The gap you see is a Recognition gap, not an execution gap

➠

🔷Cathmatics that checks:

If $Silo captures even a slice of the shared-pool market:

🔹2% = $668M

🔹5% = $1.67B (3.2x)

🔹10% = $3.34B (6.4x)

🔹15% = $5.01B (9.6x)

The upside is real, the architecture is different and the market is massive

➠

say gSilo back for the culture!! 🫡

6,8K

Silo Labs kirjasi uudelleen

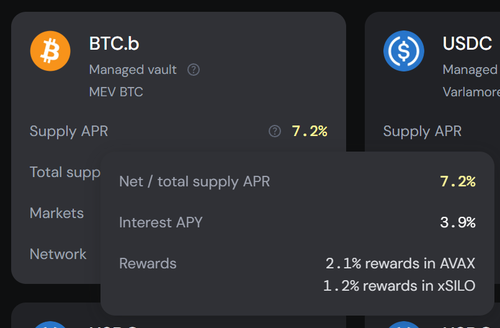

I can only assume that BTC mfs do not care for anything except real organic BTC-denominated yield.

If so, this vault by the MEV Capital lads pays a MEASLY 3.9% APR in PURE BTC.

(or if you actually care about random token rewards it's a neat lil' 7.2% APR)

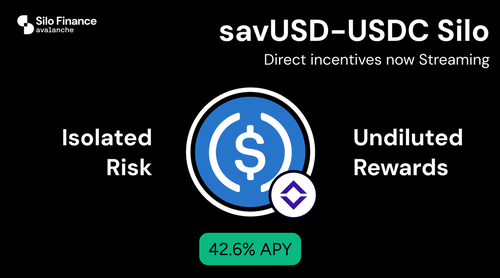

SILO AVALANCHE

9,46K

Silo Labs kirjasi uudelleen

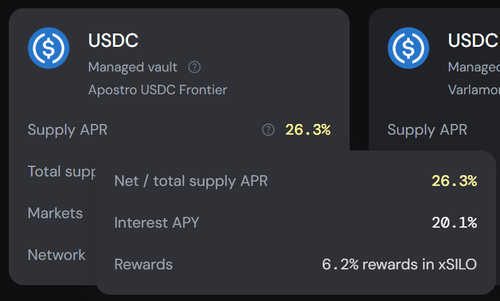

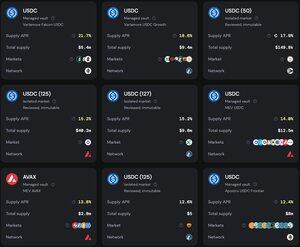

APRs for supplying on @SiloFinance are extremely high.

People are asking how it’s possible.

I’ll explain.

After reading this, you’ll clearly understand why, during risk-on market sentiment, Silo is the best lending market for supplying your stablecoins.

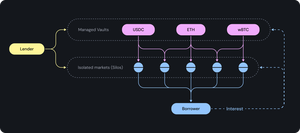

The reason is simple: the markets are called silos for a reason. They are programmable and risk-isolated.

That means when you provide liquidity, you’re always supplying to a single, isolated vault, not across the entire app on that chain.

What’s the benefit of isolated vaults?

An exploit, misconfiguration, or failed liquidation in one market doesn’t impact the others. This level of protection isn’t possible in shared-pool lending markets, where all lenders take on shared risk.

In a risk-on market, people often use leverage through lending protocols.

Vault utilization can go very high, which means borrowers are paying more interest to lenders.

But they’re fine with it, because in bull markets, they expect to make well over 30% annually on what they borrow.

Since supplied liquidity stays within each isolated pool, you should choose a pool for your stablecoins where the paired token has enough liquidity and borrowing demand.

Many of these vaults have higher utilization during risk-on markets, so you benefit from increased borrowing costs.

Why do people supply tokens and borrow stablecoins against them?

Simple. They’re betting on future upside. They don’t want to sell their assets but still want to put borrowed stablecoins to work.

If this sounds complex, just deposit into Managed Vaults.

These vaults are managed by external teams (managers) who allocate liquidity to their whitelisted markets. While users retain control over their deposits, they must trust managers to oversee some core vault functions like adding new markets, increasing supply caps, and more.

Let me know if you like this kind of content.

I can share more in the future on money market strategies and how to maximize your returns.

12,52K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin