Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

陈桂林

1. Increased volatility and frequent short-term fluctuations indicate a widening divergence between bulls and bears, with intense battles between them;

2. The current cryptocurrency market trend is strongly correlated with $CRCL;

3. I still believe that most altcoins are just runners, waiting for Bitcoin or Ethereum to cool off; only a few will emerge as the chosen ones, while the rest will either head towards zero or continue to do so;

4. If ETH is the main line, then killing BTCD is also the main line; small coins are secondary due to their low market cap, and the significant drop in BTCD has deterred me from buying, as I fear ETH is indeed the main line.

9,34K

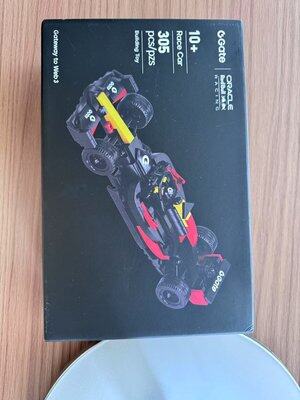

Thanks to #Gate for the little gift. This indicates that the market is starting to shift from a simple mode to a difficult mode;

Implying that I should focus more on stacking blocks and less on making trades, right?! Hahaha

However, I really lack the talent and patience for block stacking games since I was a child. I do love playing with guns, and even now I enjoy that feeling of hitting the target with precision.

Personality determines destiny; I’m destined not to be that long-term investor who builds investment towers piece by piece. I can only be a short-term trader, yes, the kind that hits the target with precision!

5,36K

Record:

They say to focus, be patient, and wait for your own opportunities, but under the influence of this emotion, in this circle, it's common to be unable to resist FOMO and to play around aimlessly;

It's better to let it flow than to block it; if you can't control it, just go for it. These past few days, I've randomly followed a few waves of altcoins and lost a few thousand U, but it felt much better (using position size for risk control);

Next, I believe the opportunities that belong to my personal track are: 1. Long Bitcoin; 2. Long Ethereum; 3. Short everything (with previous hedging coins as a focus);

I don't know which will come first, and I can't judge which is real and which is fake. I only have a vague judgment, and when the time comes, I will likely know naturally.

49,67K

The crazier the bull market, the calmer we must be.

Yesterday, I didn't tweet but took the time to summarize and organize my thoughts from the past few days:

The first question is, what is the main narrative of this entire cryptocurrency circle?

#BTC 15000➡️120000

This atypical bull market has lasted for two and a half years. Why do we say this is an atypical bull market? Because it is a bull market that has erupted during a tightening cycle.

Excluding the overall rebound from the severe drop in the early bull market (after the big bear in 2022) and the various narratives that were later debunked (L2, modularization, etc.), and excluding the super MEME season that emerged due to overall liquidity shortages during the bull market; from a holistic perspective, there is still nothing exciting in the internal narratives of the crypto space. This bull market can basically be defined as a "capital bull" led by the United States after the East-West handover in the 20-21 season.

The characteristic of this bull market is that altcoins will rebound sharply in every small trend, while Bitcoin continues to soar.

The second question is about Ethereum.

#ETH (1300➡️3800)

Following the thought process of the first question, let's look at Ethereum; before we look at Ethereum, let's first deconstruct the various stages of Bitcoin's bull market from 15476➡️30000, which experienced a rebound after a deep bear market. But what about after 30000? To now 120000? Interest rate cut expectations? ETF expectations and the capital inflow after the ETF approval?

If we connect the entire trend of Bitcoin after it broke through 30,000 in October 2023, we will have the answer.

Is this entire range (202310➡️now) peaceful? Were there any negative factors in between? The Japanese interest rate issue, war issues, the favorable conditions after Trump's inauguration, the tariff war... but did these hinder Bitcoin's rise? Not only did they not hinder it, but it also reached new highs. I want to say this is the top-level conspiracy of the "Musk and others."

Why do we need to deconstruct Bitcoin first? Because Bitcoin is the template that Ethereum has already run through, and now we can see that capital is beginning to replicate Bitcoin's path on Ethereum;

Why did Ethereum rise so quickly from 1300 to 3800, not giving people a moment to react? Aside from a brief consolidation at the beginning, it has basically been following small technical indicators since then?

Because this path is familiar, too familiar; Bitcoin has just completed it.

The third question: the next thought process.

Following the clarified thought process, we can draw the following conclusions:

1. Altcoins are just companions; at least until there is enough exciting endogenous narrative in the crypto space, altcoins can only rebound sharply; do you think it's easier to pick 3-5 coins with a 10000% increase among tens of thousands of coins, or to earn 100% on Bitcoin or Ethereum?

If you want to gamble on the former's returns, then why not check if your position has outperformed Bitcoin and Ethereum's gains?

2. We need to give Ethereum enough room for imagination. This question may seem simple, but it's not easy to execute. After all, chasing highs is a tough game; our trading system and technical system naturally reject this emotion and capital-driven rise;

3. In a bull market, technical indicators, especially small-level technical indicators, become ineffective; this is also why many technical traders missed out in this round or exited midway;

Overbought? Divergence? Waiting for a pullback? The result of waiting for a pullback is that once you exit, it's hard to get back in; because a bull market is always about emotion, not about any technicality, as bull markets are irrational.

In conclusion,

A bull market is a great retreat.

We cannot predict the overall market top, and predicting the top of individual coins is also difficult. What we can do is to reasonably plan our positions and strategies to cope with the market trends we cannot accurately predict;

Taking profits is not wrong, chasing highs is not wrong; what is wrong is taking profits and then chasing highs, chasing highs and not setting stop losses, and being repeatedly harvested after not setting stop losses due to being eroded by crazy emotions.

I remember seeing a stock market guru's saying a few days ago: after an attack, the first thing to think about is always defense; and defense without an attack is not called defense, it's called losing money; achieving a balance between offense and defense is a top-level skill;

I want to say, don't overthink it, and don't want too much. In a simple market, just earn the money that is within your ability!

126,69K

The rhythm is back, brothers.

陈桂林18.7. klo 23.30

At this time, the advantages of maintaining a hedge position are evident, as the calculations are quite perfect (confused). Currently, the account balance is basically unchanged from when Ethereum was at 3620.

49,7K

What is the difference between a novice and an experienced trader?

Novice: I feel like it's about time, I think there's at most one more wave, I feel it's at the top, I think it can go to 150,000;

Experienced trader: I feel like it's about time (gradually selling to take profits and exit without looking), I think there's at most one more wave (setting stop-loss and waiting for the preset target), I feel it's at the top (selling, waiting for validation, waiting for evidence), I think it can go to 150,000 (holding steadily, waiting for validation, waiting for evidence);

The difference between the two is the difference between making money and not making money, and in this market, being able to make money and not being able to make money is the biggest difference.

陈桂林19.7. klo 08.47

The first pullback that the public can feel in a bull market is generally an opportunity to buy on the short term, with a low probability of being trapped;

The rise in a bull market is an opportunity for gradual profit-taking, not for shorting. This type of profit-taking is considered left-side profit-taking, and after taking profits, one must endure the anxiety of missing out;

I believe the current sentiment is just reaching its peak, but making a top is a process, not a single point. There are still many opportunities in this process, but the corresponding risks have also increased;

The technical top gradually emerges during the process of reaching the sentiment top, and it hasn't emerged yet;

As for the policy top, I'm not particularly professional, but I know that Trump has just approved the entry of 401K into cryptocurrency, which is a long-term positive (similar to the approval of ETFs, which will lead to a continuous influx of funds), rather than a positive that turns into a negative after implementation. However, it doesn't have much impact on the short-term market.

43,19K

The first pullback that the public can feel in a bull market is generally an opportunity to buy on the short term, with a low probability of being trapped;

The rise in a bull market is an opportunity for gradual profit-taking, not for shorting. This type of profit-taking is considered left-side profit-taking, and after taking profits, one must endure the anxiety of missing out;

I believe the current sentiment is just reaching its peak, but making a top is a process, not a single point. There are still many opportunities in this process, but the corresponding risks have also increased;

The technical top gradually emerges during the process of reaching the sentiment top, and it hasn't emerged yet;

As for the policy top, I'm not particularly professional, but I know that Trump has just approved the entry of 401K into cryptocurrency, which is a long-term positive (similar to the approval of ETFs, which will lead to a continuous influx of funds), rather than a positive that turns into a negative after implementation. However, it doesn't have much impact on the short-term market.

陈桂林19.7. klo 06.23

GM!

What is the pullback in a bull market (——)?

What is the peak in a bull market (——)?

Has the sentiment peaked? Has the technical analysis peaked? Has the policy peaked?

91,27K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin