Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Jesse

working on @asula_labs || reading/writing with @bedlamresearch || yapping about bitcoin, crypto, money, etc

If you are considering buying $SONN based on the Hyperliquid treasury company announcement, read this:

- Legacy SONN holders end up with ~1.2 % of the new company

- HSI (the name of the new company) will have assets valued at ~$888M, meaning implied net asset value of SONN is about $10.7m

- $10.7m/3.17m (amt. of SONN shares) means NAV for SONN is $3.36

It's currently trading at $9.41 ($16.4m), so mNAV is about 2.8x

This is actually about middle of the pack when it comes to treasury companies, but lower compared to Ethereum, Solana or management teams that have bigger plans (NAKA or STRIVE)

Microstrategy post BTC announcement regularly saw shocks up above 4 even 5x NAV. It has settled around 2:

Each of the Ethereum and Solana treasury companies are closer to a multiple of 6

There is a lot of execution risk, but the case for this at 2.8x while other assets with ETFs are sitting at 6 is an important detail that is easy to miss

(h/t @Presto_Research)

20,72K

To add to this, the two public raises above PUMP were EOS (raised $4B) and TON (raised $1.7B)

EOS was the largest scam/slow rug of all time, TON was shut down by the SEC and had to refund $1.2B

Probably fair to consider this the largest successful public raise in crypto

Abdul12.7. klo 22.59

pumpdotfun ICO raising $500 million is officially the third biggest of all time

every other ICO in the top 10 is from the 2017 era

2025 cycle is absolutely cooking so far

5,82K

Jesse kirjasi uudelleen

Yes, this is what everyone wants, what makes sense and what we think will happen and why we so bullish (95% on most of the coins) approval. Q is what will the standards be. We think they'll likely be loose enough where the vast majority of Top 50 coins would be ok to be ETF-ized.

149,74K

I may be Opening Bell pilled from @superstatefunds

(I think) this could be used to do a *reverse* treasury company to bring stock exposure onchain?

better for after hours pricing where tokenized equities are a pain, this would just be NAV drift that corrects in normal hours

Superstate1.7. klo 23.32

1/ Most platforms tokenize exposure. Opening Bell tokenizes the real thing, directly from the issuer.

Yesterday, we showed how that model unlocks global access.

Today: Why it give investors true ownership, not synthetic claims.

561

This pressure will kill a lot of lazy treasury companies

It either pushes them to pursue money that cannot buy US ETFs (still a LOT there), or they need to figure other ways to differentiate

Already BTC companies are in derivatives & lending, should be a trend for other tokens

Eleanor Terrett1.7. klo 23.15

🚨SCOOP: The @SECGov is in the early stages of creating a generic listing standard for token-based ETFs in coordination with exchanges.

The thinking, I’m told, is that if a token meets the criteria, issuers could skip the 19b-4 process, file an S-1, wait 75 days, and the exchange could list it. This approach could save both issuers and the SEC a lot of paperwork and back-and-forth on comments.

What those listing standards would be is still unclear, but some are speculating market cap, trading volume and liquidity are all under consideration.

Through a spokesperson, the SEC declined to comment.

372

If someone asked me: this time next year, what tokens are in the 3 highest volume pairs on Solana?

I don’t even have a solid guess beyond SOL and USDC

mert | helius.dev1.7. klo 02.11

this is very cool

you can now swap into stocks like NVDA directly on Solana!

NVDA, CRCL, TSLA, MSTR and more

internet capital markets are here

1,44K

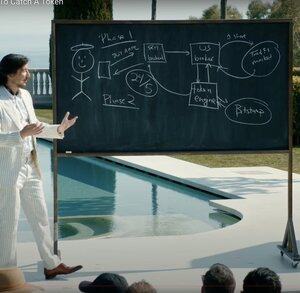

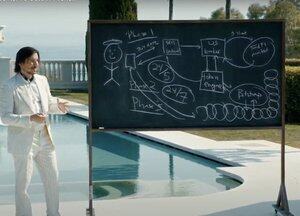

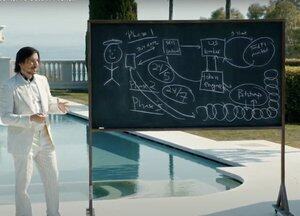

It was actually cool to see Vlad walk through their master plan on a chalkboard. Robinhood Crypto is now just Robinhood

TLDR;

Phase 1: US broker fills orders and mints stock token to user, live today for EU users, available 24/5

Phase 2: Move to 24/7, use Bitstamp to tokenize over weekends

Phase 3: Allow tokens to be transferred out of Robinhood and into wallet, use in DeFi

1,54K

Robinhood Crypto is now just Robinhood

It was actually cool to see Vlad walk through their master plan on a chalkboard.

TLDR;

Phase 1: US broker fills orders and mints stock token to user, live today for EU users, available 24/5

Phase 2: Move to 24/7, use Bitstamp to tokenize over weekends

Phase 3: Allow tokens to be transferred out of Robinhood and into wallet, use in DeFi

159

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin