Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Mr. Lin | Pendle Maxi 🧸

@pendle_fi addictooor | Occasionally whips up some DeFi contents

Sidelined?

Still time to get cheap $ENA with YT-usde/susde/eusde/tusde on @pendle_fi.

See you on the other side.

Pendle

Ethena Labs19 tuntia sitten

StablecoinX Inc. @stablecoin_x has announced a $360 million capital raise to purchase $ENA and will seek to list its Class A common shares on the Nasdaq Global Market under the ticker symbol "USDE", which includes a $60 million contribution of ENA from the Ethena Foundation

Equity markets will now have direct access and exposure to the most important emerging trend in all of finance:

The growth of digital dollars and stablecoins.

To bootstrap its acquisition strategy, StablecoinX Inc. will use all of the $260 million cash proceeds from the raise (less amounts for certain expenses) to buy locked ENA from a subsidiary of the Ethena Foundation.

Starting today, the Ethena Foundation subsidiary (via third-party market makers) will use 100% of the $260 million cash proceeds from the token sale to strategically purchase $ENA across publicly traded venues over the coming weeks, further aligning the Foundation’s incentives with those of StableCoinX shareholders.

The planned deployment schedule is approximately $5m daily from today over the course of the next 6 weeks. At current prices $260m represents roughly 8% of circulating supply.

Importantly, the Ethena Foundation has the right to veto any sales of $ENA by StableCoinX at its sole discretion. Ideally, tokens will never be sold with a sole focus on accumulation.

To the extent StableCoinX subsequently raises capital with the intent of purchasing additional locked ENA from the Ethena Foundation or its affiliates, cash proceeds from those token sales are planned to be used to purchase spot $ENA.

StableCoinX's treasury strategy is a deliberate, multi‑year capital allocation strategy that will enables StableCoinX to capture the enormous value of the secular surge in demand for digital dollars while compounding ENA per share to the benefit of shareholders.

13,47K

Sidelined?

There's still time.

Get your cheap $ENA on @pendle_fi and buy YT-usde/susde/eusde/tusde.

Only on Pendle.

Ethena Labs19 tuntia sitten

StablecoinX Inc. @stablecoin_x has announced a $360 million capital raise to purchase $ENA and will seek to list its Class A common shares on the Nasdaq Global Market under the ticker symbol "USDE", which includes a $60 million contribution of ENA from the Ethena Foundation

Equity markets will now have direct access and exposure to the most important emerging trend in all of finance:

The growth of digital dollars and stablecoins.

To bootstrap its acquisition strategy, StablecoinX Inc. will use all of the $260 million cash proceeds from the raise (less amounts for certain expenses) to buy locked ENA from a subsidiary of the Ethena Foundation.

Starting today, the Ethena Foundation subsidiary (via third-party market makers) will use 100% of the $260 million cash proceeds from the token sale to strategically purchase $ENA across publicly traded venues over the coming weeks, further aligning the Foundation’s incentives with those of StableCoinX shareholders.

The planned deployment schedule is approximately $5m daily from today over the course of the next 6 weeks. At current prices $260m represents roughly 8% of circulating supply.

Importantly, the Ethena Foundation has the right to veto any sales of $ENA by StableCoinX at its sole discretion. Ideally, tokens will never be sold with a sole focus on accumulation.

To the extent StableCoinX subsequently raises capital with the intent of purchasing additional locked ENA from the Ethena Foundation or its affiliates, cash proceeds from those token sales are planned to be used to purchase spot $ENA.

StableCoinX's treasury strategy is a deliberate, multi‑year capital allocation strategy that will enables StableCoinX to capture the enormous value of the secular surge in demand for digital dollars while compounding ENA per share to the benefit of shareholders.

10,82K

Mr. Lin | Pendle Maxi 🧸 kirjasi uudelleen

After a long period of separation, things must come together, and after a long period of coming together, things must separate. The FDV/TVL ratios of the three projects, Ethena, Usual, and Resolv, have recently begun to show significant differentiation after a period of convergence.

Part One: Usual's debut.

After its TGE, Usual surged with momentum, with an FDV/TVL ratio reaching as high as 4 times. However, as the saying goes in the community: "After a sharp rise, there is often a lot of false heat." Sure enough, after the excitement faded, it began to decline, gradually aligning with Ethena. Since the end of April, the two have been inseparable, making it hard for people to distinguish between them.

Part Two: Resolv enters the fray.

Fast forward to June, Resolv officially made its entrance. Being new to the scene, it naturally attracted a lot of attention, with its FDV/TVL ratio once standing tall. But soon, it also faced the harsh realities of the market, falling from the spotlight to stand alongside its older brothers. On June 18, the three brothers finally saw their FDV/TVL ratios drop to 0.58, sharing a cup of tea and living the same life.

However, the crypto world is never at peace, and with ETH recently stirring up the storm again, the FDV/TVL ratios of Ethena, Usual, and Resolv have begun to widen once more, reaching a level of differentiation not seen since February of this year.

The three brothers, will they each go their separate ways, or will they once again raise a toast together? To know what happens next, stay tuned for the next episode.

6,57K

Mr. Lin | Pendle Maxi 🧸 kirjasi uudelleen

🔔Ethena Whales 🐳

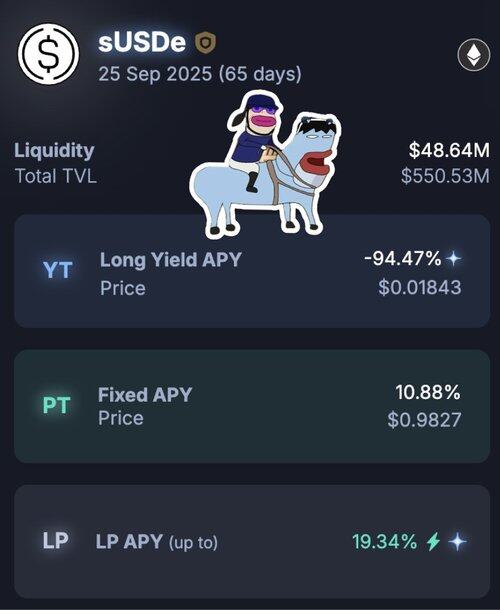

Time to roll over: the juiiicy Sept @pendle_fi pool is now offering 11% APY for PT.

USDe TVL back to ATH >$6bn 🔥

ENA up 47% over the last week 🆙

Converge squad ready to sprint 🏃♂️

Hopefully Aave will raise the cap soon for PT Sept - poke poke mr @lemiscate

6,47K

Mr. Lin | Pendle Maxi 🧸 kirjasi uudelleen

Since mid-June, I have been reminding everyone through different channels that the points from @ethena_labs are worth mining and worth ambushing.

I hope everyone has taken it to heart.

@pendle_fi YT has already earned points and mined prices again.

YT is similar to CALL options, and it has great explosive potential at the turning point from bear to bull.

Buying YT at a low position means locking in a cheap and fixed-cost high-leverage fund.

15,91K

Mr. Lin | Pendle Maxi 🧸 kirjasi uudelleen

Recently, due to the increase in fees, the interest given by @ethena_labs has risen significantly, from 4% all the way up to over 8%. This has also caused the coin price to shoot up from 0.3 to 0.5. I've noticed that many actuaries are quietly calculating points, using @pendle_fi to earn a lot of points.

4,42K

Mr. Lin | Pendle Maxi 🧸 kirjasi uudelleen

Not long ago, Pendle's CEO TN @tn_pendle was invited to our office for a discussion interview on the future of DeFi and RWA, and we discussed:

▪️The future of DeFi

▫️TN believes that as more capital flows in, DeFi will show larger-scale applications that may even be more useful than we currently imagine.

▫️ Regarding yield tokenization: It refers to the transformation of future income streams into tokens that can be traded on the chain, which not only empowers the value of assets but also provides more controllable and considerable returns for the market and users while unlocking each asset yield transaction.

▫️ About options: Although options are very important in the financial sector, there is room for growth and improvement as there are no successful penetration cases on the chain that have been successfully implemented.

▪️ About stablecoins

▫️ Stablecoins are one of the most prominent use cases for crypto assets because they are a way to transfer money far superiorly over traditional transfers. Many projects offer stablecoin products and innovate around stablecoin yields.

▫️DeFi protocols attract users by offering attractive stablecoin yields, such as 5%-10% yield on USDe. The main driving force behind this strategy is the strong pursuit of yield incentives by institutions and individuals, as holding traditional stablecoins often does not yield high stable returns.

▪️The Rise of RWAs:

▫️ In terms of product development of RWA tokenization, the possible product life cycle model is slow at first, driving growth through continuous iteration of products, eventually reaching a critical point, and then entering the stage of explosive growth.

TN is really a very good and gentle founder, after the interview, he sent him away, he was going to help call a taxi, he looked at his watch and said that this point should be very congested, I will just take the subway, there is a subway station next to your company. I am very happy to be able to communicate with this kind of low-key and high-profile industry builder~

45,68K

Mr. Lin | Pendle Maxi 🧸 kirjasi uudelleen

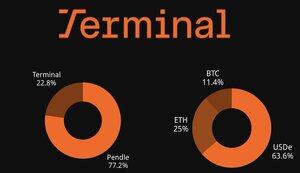

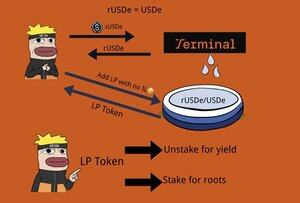

@Terminal_fi × @pendle_fi × Ethena

→ 10Bドル級の資金がConvergeに集まる理由・エアドロ狙いのチャンスについて

🔹Converge=EthenaとあのBlackRockと緊密に結びついているSecuritizeが共同で立ち上げる EVM互換L1

🔹Terminal = Convergeの流動性ハブ、Uniswap+IL最小化イノベーション

🔹Redeemable tokenと呼ばれるもので、ILを最小化することを試みる

🔹Pendleでは「ポイント60x・イールド10%以上」

Terminalについて&収益ライン試算👇

普通参加だけしたい方👇

ポイント最大、低リスク、10%イールド→

ダッシュボード・リファ

→

余談:

資金規模がConvergeの構想ほど大きくないチェーンでは、必ずしもTerminalが競争力を持つとは限りませんが、資金が大きくなると、ILによる機会損失がデカくなると着眼をして、作られたのが記事でも持っと詳しくカバーしているTerminal。

もしかするとVe3,3?にする可能性もある👀

1,72K

Mr. Lin | Pendle Maxi 🧸 kirjasi uudelleen

When we talk about speculation in crypto, most people immediately think of price charts - longing BTC, aping into alts, or catching memecoin pumps.

But a quiet revolution is unfolding in DeFi.

@pendle_fi is redefining what it means to speculate, not on price but on yield. 🧵👇

9,26K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin