Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Tat Thang

• Forbes Web3 2024 Content Creator

• Ambassador @opencampus_xyz

• Creator @creators_nexus // @SeedifyFund

Kaito Launchpad just opened its first two pledging rounds. Here's how it's going after 37 minutes 👇

🟤 Espresso

- Raise Target: $4,000,000

- Allocation Requested: $11,098 (~0.28%)

🟢 Theoriq

- Raise Target: $2,000,000

- Allocation Requested: $594,241 (~29.7%)

Still over 3 hours left in the pledging phase.

What do you think this early difference says?

285

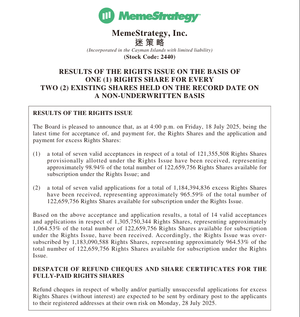

Big news out of MemeStrategy: their highly-watched Rights Issue just wrapped up and the results are wild.

---------

1/ Oversubscribed by 964%

The company offered ~122.6M new shares to existing holders on a 1-for-2 basis.

They received over 1.3 billion share applications.

That’s 1,064% demand for what was on offer oversubscribed by nearly 10x.

Raised Capital: ~HK$153M ($19.6M)

According to prior filings, this capital is earmarked for business expansion.

It’s now up to MemeStrategy to show what exactly that means.

---------

2/ Shareholding Structure Remains Intact

Ray Chan, via Home Office Development Ltd, maintains 64.31% control, unchanged from before.

Public holders now own the remaining 35.69% of shares.

That means:

No dilution of founder control.

But also, no shift in power dynamic or new strategic investors entering through this round.

---------

3/ Share Price Reaction: +5.28%

Post-announcement, MemeStrategy’s stock rose to HKD 3.19, gaining over 5% on the day.

That shows positive short-term sentiment.

Investors seem to be betting on two things:

The capital raise strengthens the balance sheet.

The demand signals institutional or strategic confidence.

---------

4/ So What’s Next?

i/ What’s Working:

- The raise was successful, and demand was overwhelming.

- Market reaction is positive at least for now.

- The upcoming issuance of shares (trading begins Aug 11) may bring renewed attention.

ii/ What Needs Watching:

- Execution risk: The company has not yet disclosed concrete plans for deploying the funds.

- Communication: MemeStrategy and Memeland still haven’t clearly explained how this public-side raise ties back to product-side developments.

---------

5/ Connection to Memeland?

This won’t directly pump NFT floors or MEME token price.

But indirectly:

- It strengthens the corporate side of the ecosystem (MemeStrategy is the HKEX-listed vehicle).

- It gives them more resources to push whatever their next move is whether it's in commerce, entertainment, or finance.

In short, this was a win.

Now the pressure is on the team to turn it into momentum not just money in the bank.

Because if nothing material comes from this raise. People won’t forget how much they just over-subscribed.

Let’s see what they do next 🏴☠️

2,11K

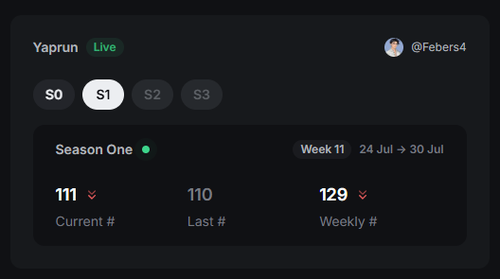

Scrolling through TL and saw a lot of my friends complaining that they dropped in Infinex Yaprun this week.

And checking my own, I saw the same thing lol.

I dropped 26 ranks this week and 1 rank in the overall ranking. Not sure why because I didn't change much this week. But maybe the problem is that when I'm still going at the same speed and others are speeding up, I'm definitely left behind, right?

Also saw some new people entering the rankings this week. Everything is still great and stable. There are new projects and new trends but Infinex is still being cared for and active every day.

Congratulations to @infinex team and to those who did well this week.

234

Is InfoFi Really Dying?

I’ve been watching InfoFi evolve from the early days when it felt like a new way to connect projects with real users right up to now, where everyone’s asking if it’s basically on its last legs.

So here’s my take, laid out honestly, with all the good and bad.

1/ What Went Right

InfoFi came in hot. It gave projects a way to reach users, made earning in crypto more accessible, and built this whole new layer where people could get paid for their attention, ideas, and engagement.

- Brands loved the hype and onboarding spikes.

- Users loved the rewards and leaderboards.

- Platforms like Kaito made real money (listing fees, token taxes, SaaS).

But lately, if you scroll the timeline or talk to anyone in the trenches, you can feel the energy shift. The system just isn’t working the way it used to.

2/ Why the Old Model Is Breaking

Let’s be real. Extraction is everywhere.

Most “active” users are farming for tokens. They’re not sticking around to use the products or build communities.

Projects shell out massive listing fees and token allocations for campaigns, but when the dust settles, barely any new loyal users remain.

Genuine contributors, builders, and thoughtful KOLs get drowned out by copy-paste threads, AI content, and engagement games.

It’s becoming a grindfest, not a place for real discovery or growth.

3/ Platforms Win But Projects and Users Lose

It’s hard to ignore:

Platforms like Kaito keep raking in listing fees and cut of token taxes even if actual project ROI is flat or negative.

Projects pay $150k or more just to get listed, then hand out huge token allocations that often fuel quick dumps (not long-term communities).

Users especially those looking for deeper involvement get burned out by the endless grind and low-effort content.

4/ Is There Any Silver Lining?

Yeah, InfoFi did offer some fresh opportunities:

- More people got a shot at earning in crypto without needing to code or spend big.

- Some standout projects and users built new followings, learnings, and even jobs out of this system.

- When anti-bot tools, curation, and real-user rewards work, you do see better conversations and longer retention.

But right now, those feel like exceptions, not the rule.

The platform that cracks this shifting from “who farms hardest” to “who brings real value” will own the next chapter of crypto social.

-------------

5/ Final Thoughts

InfoFi blew up for a reason, and it brought a lot of people into the space. But if nothing changes, the cycle of big fees, low impact, endless farming, and mounting fatigue will just keep going till nobody cares anymore.

If you care about the future of crypto community, now’s the time to push for smarter incentives, real voices, and transparency about what works and what doesn’t.

310

Đôi lời tâm sự mỏng với anh em trong cộng đồng.

Thật ra kế hoạch năm nay của mình hoàn toàn không có việc sẽ build cái gì liên quan đến cộng đồng và nhất là ở Việt Nam

Phần nhiều là vì mình khá bận với nhiều vai trò khác nhau, còn lại thì mình cũng ngại việc build 1 account song ngữ.

Nhưng đôi khi có nhiều chuyện xảy ra không như mình đã nghĩ. Xuất phát từ 1 drama với 1 KOL ở Việt Nam mà mình mới quyết định “muốn làm gì đó” để anh em chấm dứt việc bị dắt mũi.

Như anh em cũng đã thấy thì mình build cộng đồng này ko nhằm mục đích kinh tế, cũng không có ý định gì về việc kiếm fame từ đây. Tất cả là free và hoàn toàn dựa trên kiến thức và trải nghiệm của bản thân. Nói không với mõm và bịa kiến thức để lùa cộng đồng.

Quan điểm và mục tiêu thì vẫn nhất quán là support cộng đồng Creator Việt Nam có thể có kĩ năng và được trang bị tốt hơn để đi thi đấu với quốc tế.

Nhưng để làm được những điều đó thì không thể dựa vào 1 mình mình. Đó sẽ cần là tầm nhìn chung của rất nhiều người không chỉ là ở trong đây mà còn là những Creator khác ngoài kia mang dòng máu Việt Nam.

Mục đích của mình khi tạo ra cộng đồng này là để các bạn hãy mạnh dạn, chủ động và nghiêm túc với việc build branding. Đừng ngại việc chia sẻ và viết về những hành trình, khó khăn hoặc kể cả là flex thành tựu của mình ở đây. Vì việc viết hay bất cứ công việc nào khác. Chúng ta chỉ có thể master nó khi chúng ta đã tập luyện và lặp lại nó rất nhiều lần.

Qua một thời gian ngắn kết nối và theo dõi thì mình cũng đã thấy một vài anh em bắt đầu có kết quả nhất định sau khi thay đổi. Đó thật sự là niềm vui với mình.

Và như mọi người đều đã thấy Chính phủ cũng đã có những bước đi rõ ràng hơn để hiện thực và hợp pháp hóa Crypto ở Việt Nam. Vì vậy mình tin rằng trong tương lai những người có kĩ năng, kinh nghiệm và góc nhìn sâu sắc trong ngành này sẽ có nhiều con đường để tiếp tục phát triển.

Hãy kiên định và tiếp tục tiến lên.

Mình rất tự hào khi được đồng hành cùng mọi người trên hành trình này.

944

Thinking of joining the new KaitoAI Capital Launchpad with Theoriq?

I did the math so you don’t have to.

Here’s what you should really know before throwing $1,000 into it 🧵

-----------

1. TL;DR of the raise:

• Raise: $2M

• Valuation: $75M FDV

• Token Supply: 1B

Unlocks:

• 25% at TGE

• 37.5% after 12 months (cliff)

• 37.5% linear (months 13–24)

So if you invest $1,000, you get 13,333 tokens at $0.075.

But you can only sell 25% at TGE → 3,333 tokens = $250 unlocked.

-----------

2. When do you break even?

To recover your $1,000 at TGE, those 3,333 tokens must be worth $1,000.

That means:

→ Token needs to launch at $0.30

→ That’s a 4x from entry price

-----------

3. Can it 4x? Maybe. But here’s the reality check:

i/ Big VC bag overhead

- That’s 300M tokens, and you're only getting access to a slice of 2M raise now.

- You’re joining at the tail-end of the raise

- Early seed buyers likely got in much cheaper than $0.075

ii/ Unknown circulating supply at TGE

- We know you unlock 25%

- But how much will be live from treasury, team, community, or other VCs?

- A low float could cause a pump or a dump.

iii/ $75M FDV is not cheap

- It’s already halfway to $150M (previous round valuation)

- For a token with no TGE, no utility live yet, and early-stage product traction. This is mid-to-high risk

-----------

4. So is it bearish? Not necessarily.

You can win if:

- The TGE pumps 3-5x

- There’s a big KOL/media push

- Circulating supply is low enough for a demand squeeze

- You’re down to hold for 12–24 months

But if you're hoping for a quick flip, it's high risk.

-----------

5. Context matters:

- Theoriq raised $10.2M from solid names: IOSG, HashKey, Hack VC, Hypersphere, SNZ, etc.

- They’re launching Alpha Studio, AlphaSwarm, and set aside 18% of tokens for the community.

Tokenomics:

• 30% Investors

• 28% Treasury

• 24% Team (3Y vest)

• 18% Community (yap-to-earn, ambassadors, etc)

Still fundamentals don’t cancel out valuation risk.

-----------

6. Recap: If you invest $1,000

Token at $0.075 → sell $250 at TGE

Token at $0.15 → get $500 (still -50%)

Token at $0.30 → break even

Token at $0.50+ → early profit

The question is: Do you believe $THQ can 4x at launch?

That’s the bet.

-----------

7. Final thoughts

This post isn’t hype or FUD.

It’s just basic math, context, and protecting your capital.

If it helps, drop a like or RT for others doing due diligence

NFA, do your own research, protect your capital.

Thank you

587

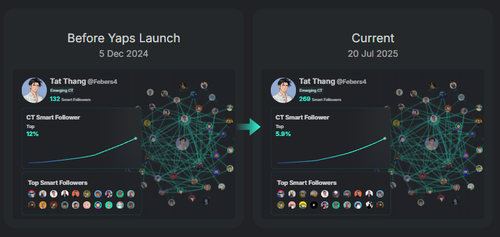

8 months on Kaito and the growth is real.

More smart followers. Higher on the leaderboards. But more importantly: deeper connections and sharper insights.

No spam. No shortcuts. All organic.

Just showing up, staying consistent and posting what I actually believe in.

Kaito isn’t just a grindfest.

If you play it right, it becomes a signal amplifier

Onwards 🚀

597

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin