Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Joker Frog

Remilia Maxi // Shitpost Connoisseur

Retired Stay at Home Dad

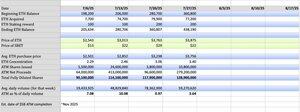

Joker Frog kirjasi uudelleen

$SBET I am extremely bullish. Just look at the last 4 weeks and extrapolate the trends. Everything you need 👇 (for example, they are acquiring >75K $ETH each week. A conservative estimate is that ~5% of daily volume is ATM sales. The biggest ATM was done when SBET was at $22. We are at $20. I project SBET to wrap up the latest 5B ATM before November ends, and they will have over 1.3M ETH on the balance sheet, generating >1800 ETH per month in staking rewards alone.

$20 —> $100 (my $SBET base case) 🟢🌕

9,98K

Joker Frog kirjasi uudelleen

Look, I get it. Everyone’s losing their minds over SBET trading at premium to the NAV while the same folks were bull-posting when Metaplanet was running hot at 6-7x and nobody batted an eye. The market’s got its head screwed on backwards sometimes.

ETH isn’t just sitting there like digital gold. This thing’s got legs. While Bitcoin’s playing store of value, ETH is out there grinding in DeFi, generating actual yield. You can stake it, restake it, throw it into liquidity pools – it’s like having a rental property that also appreciates. Your staked ETH isn’t just securing the main chain anymore – it’s securing other protocols, earning extra yield.

Bitcoin maxis love to talk scarcity, but ETH’s actually burning supply when demand rises. Every transaction, every smart contract execution – poof, more ETH gone forever. With zkEVM Linea as L2, it will share more profits to L1, which benefits ETH holders (and helps SBET).

SBET’s sitting at the intersection of institutional tokenization, ETH’s higher volatility, its adoption in TradFi, and its deeply rooted DeFi activities.

If the thesis is that traditional finance will get more efficient over time, you can’t achieve that efficiency without ETH. It’s the digital oil, and everyone will require it to do their work.

All the shit talkers throwing a tantrum over NAV are missing the forest for the trees. This isn’t about today’s multiple – it’s about positioning for tomorrow’s financial architecture.

When MSTR started buying Bitcoin, it was bullied and roasted. Now all the companies and governments are hoarding it. Similarly, all BTC maxis hating on ETH will soon realize that BTC alone cannot help run real-world applications. You need a computer (smart contracts) attached to the blockchain.

Think bigger picture and digest the volatility.

Enough of the rant. Back to charts.

5,67K

Joker Frog kirjasi uudelleen

$GLXY just feels like such a good deal here, ~$10B market cap, ~$3B of which is in crypto $BTC, $ETH, $SOL, $HYPE, $SUI, etc, crypto infrastructure and VC investments + cash.

So you have ~$7B of equity value - for ALL of Galaxy's crypto business lines, joint ventures and Helios (+ future Bitcoin mining site acquisitions).

Helios ALONE could be worth anywhere between $13.5B - $43B based on their current power approvals of 800MW + potential approvals to bring the site to a full 2.5GW and the $CRWV deal they have signed.

If you want to dive deeper into Helios you must read the report by @RHouseResearch.

But in my opinion $7B for all the crypto business lines, JVs and Helios is a steal!

11,21K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin